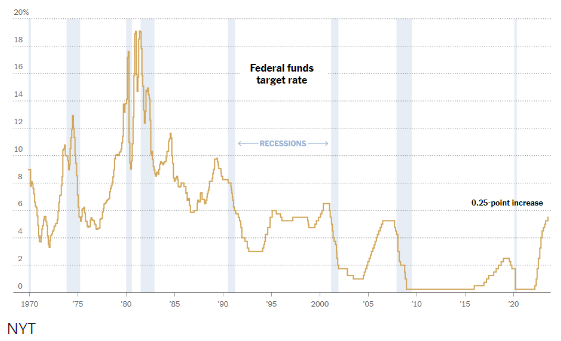

The latest decisions by the Federal Reserve and the European Central Bank have sent ripples through the markets, impacting stocks and fixed-income assets. As expected, the Federal Reserve raised interest rates, marking the 11th rate hike since March 2022, bringing it to the highest level in 22 years. However, what stood out more was Federal Reserve Chairman Jerome Powell’s emphatic statement that the Fed is no longer forecasting a recession, thanks to the latest economic data showing the resilience of the U.S. economy.

On the other side of the Atlantic, the European Central Bank (ECB) hiked rates by a small increment despite disappointing macro data, emphasizing a willingness to continue rate hikes. While both central banks have expressed confidence in their policy measures, the markets are closely monitoring inflation and economic developments.

Market Indicators and Investor Sentiment

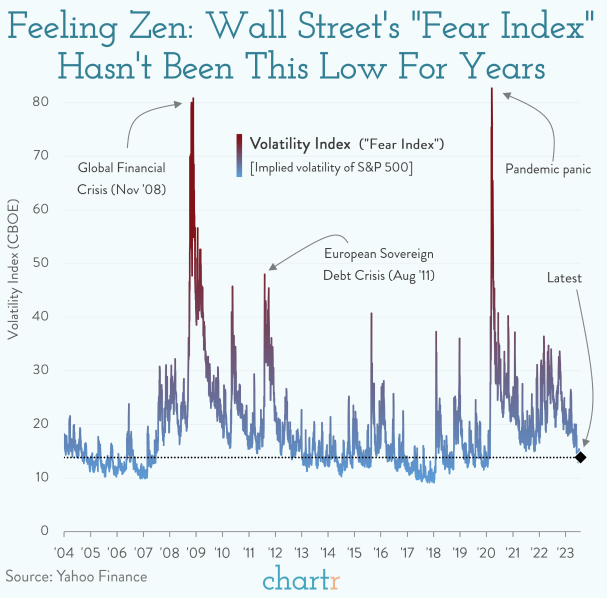

US stocks have surged, with the S&P 500 Index climbing 19% this year, and the Volatility Index (VIX), or the “Fear Index,” reaching lows not seen since February 2020. This low VIX reading signals that investors expect a relatively stable market in the near term, contrasting sharply with the panic-inducing readings witnessed during global crises.

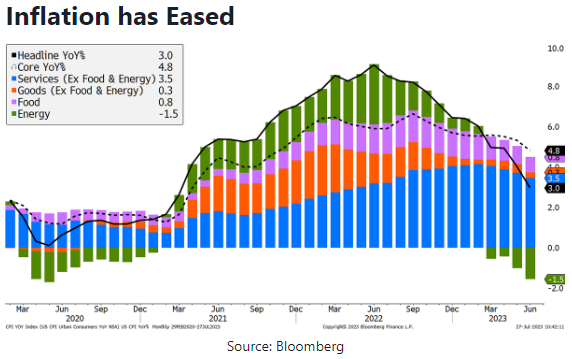

Investors are finding comfort in three main factors. Firstly, inflation has peaked and appears to be on a downward trajectory, allowing the Federal Reserve to reconsider future interest rate hikes. Secondly, the banking sector, which experienced a tumultuous period earlier in the year, is now reporting robust results. Lastly, the risk of a recession seems to have diminished, with Federal Reserve Chairman Jerome Powell’s reassuring statement about the absence of a recession, and with consumer confidence rising, unemployment remaining low, and corporate earnings performing well.

Opportunities Amidst Volatility

The markets have experienced volatility this year due to concerns about inflation, further rate hikes, and economic slowdowns. Despite this uncertainty, there have been excellent buying opportunities for both stocks and bonds. In equity markets, a select few tech stocks have driven the S&P 500 Index’s rise, while the rest of the market has lagged, despite the overall resilience of the economy and positive earnings. In the fixed-income markets, high-yielding corporate and government bonds are attractive, offering returns comparable to equities at around six to eight percent.

As inflation shows signs of cooling and central banks approach the end of their rate hiking cycles, investors have a unique opportunity to capitalize on high rates. The rate hiking cycle in the US is expected to be nearly complete, although the central bank will remain vigilant to maintain inflation around its two percent target. Investors are increasingly favouring the concept of a “soft landing,” which suggests a gradual economic slowdown without a sharp downturn.

In conclusion, investors must navigate the impact of rate hikes and inflation as they position themselves in the market. While uncertainties persist, strategic opportunities are emerging for those who can identify and seize them, as central banks seek to strike a balance between controlling inflation and supporting economic growth. The assurance of no recession, stated by Jerome Powell, adds a positive dimension to the market outlook.

FAQs

- Did the Federal Reserve raise interest rates recently?

Yes, the Federal Reserve recently raised interest rates to a range of 5.25% to 5.5%, making it the 11th rate hike since March 2022. This is the highest rate in 22 years and reflects the central bank’s efforts to rein in inflation.

- What stood out in Federal Reserve Chairman Jerome Powell’s recent statement?

Federal Reserve Chairman Jerome Powell stated that the Fed is no longer forecasting a recession. He emphasized the resilience of the U.S. economy and a data-dependent approach to determine the extent of additional policy firming.

- What is the current sentiment in the European Central Bank (ECB) regarding rate hikes?

The European Central Bank (ECB) recently hiked rates by a small increment of 25 basis points, bringing the interest rate to 3.75%. The accompanying policy statement indicated a willingness to keep the door open for further rate hikes despite some disappointing macro data.

- Why are investors finding comfort in the markets?

Investors are finding comfort in several factors, including the expectation that inflation has peaked and is showing signs of cooling. Additionally, strong results from the banking sector and a decline in the risk of a recession have contributed to investor sentiment.

- How are equity and fixed-income markets performing in 2023?

Both equity and fixed-income markets have been volatile in 2023 due to concerns about inflation, rate hikes, and economic slowdown. However, amidst the volatility, there have been excellent buying opportunities, particularly in high-yielding corporate bonds and government bonds.

- Is the Federal Reserve likely to continue rate hikes in the near future?

The Federal Reserve has indicated that it will continue to take a data-dependent approach in determining the extent of additional policy firming. While the rate hiking cycle is nearing its end, the central bank remains focused on maintaining inflation around its two percent target.

- What is the current market sentiment regarding a “soft landing”?

Investors are increasingly favouring the concept of a “soft landing,” which suggests a gradual economic slowdown without a sharp downturn. The assurance of no recession from Federal Reserve Chairman Jerome Powell adds to the positive outlook for a soft landing.

- Are there strategic opportunities for investors amidst the market volatility?

Yes, amidst the market volatility, strategic opportunities have emerged for investors in both stocks and bonds. The markets have presented excellent buying opportunities for those who can identify and capitalise on them.

Schedule Your Personalised Consultation Today!

Ready to take the next step towards achieving your financial goals? Schedule a call with one of our expert advisers today! Our team are here to provide guidance based on your unique financial situation and help you make the most of the insights gained from our resources. Don’t miss out on the opportunity to receive professional advice and tailored strategies. Take action now and let us guide you towards a brighter financial future.

Discover Market Insights!

Are you eager to make informed and strategic investment decisions? Look no further! Visit our Market Analysis page now to gain exclusive access to expert insights, trends, and data that can help shape your investment journey.

Access Our Financial Calculators!

Take control of your financial future with our comprehensive suite of Financial Calculators. Whether you’re planning for retirement, considering a mortgage, or exploring investment opportunities, our powerful tools can provide valuable insights to guide your decisions.

Disclaimer: The information provided on this website is for general informational purposes only and does not constitute financial or investment advice. The content on this website should not be considered as a recommendation or offer to buy or sell any securities or financial instruments. Investing in securities involves risks, and past performance is not indicative of future results. The value of an investment may fall as well as rise. You may get back less than the amount invested. Any reliance you place on such information is strictly at your own risk. The commentary provided should not be taken as financial advice as it does not take your financial circumstances into consideration and does not provide an objective view with your requirements in mind. The views are our opinions at the time of writing and may change based on incoming information. The data shared may be incorrect or out-dated at the time of reading. Our opinions are subject to change without notice and we are not under any obligation to update or keep this information current. The views expressed may no longer be current and may have already been acted upon. Tax treatment depends on individual circumstances and all tax rules may change in the future. The information contained on this page has been prepared using all reasonable care. However, it is not guaranteed as to its accuracy, and it is published solely for information purposes.