As we embark on a new week in the global markets, there is an air of caution. The expectation of a slow start to the week is quite evident with the lack of significant news to instigate any major movements. Insights from board members at the Bank of Japan reveal an intention to raise the cap on bond yields. This approach is viewed as a strategy to prolong the period of monetary easing, rather than marking an immediate exit from the current policy.

Inflation Data Takes Centre Stage

This week, all eyes are on inflation data, with vital readings coming in from both China on Wednesday and the United States on Thursday. The market is bracing itself for these significant updates, as they present a notable test. The previous month’s unexpected dip in U.S. CPI generated substantial positive waves in markets. Therefore, the risk of meeting expectations could lead to investor disappointment.

Housing Markets: UK’s Economic Signals

In the realm of housing, the UK has experienced a decline in house prices for the fourth consecutive month in July, as per the Halifax data. This trend only adds to the growing narrative of a housing market that persists in demonstrating resilience despite daunting economic challenges.

Lessons from the Previous Week: A Look at the Global Economy

Growth in Eurozone and Challenges in China

Data from last week provides insights into the Eurozone’s return to growth in Q2, while core inflation in the bloc contradicts expectations of a decrease. Meanwhile, the contraction in China’s manufacturing activity in July presents new evidence of the slowdown in the world’s second-largest economy.

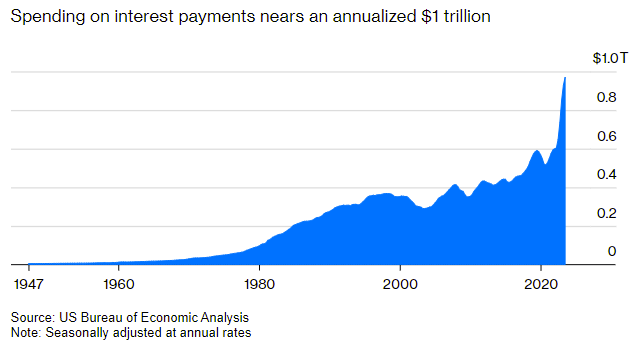

U.S. Debt Downgraded

The U.S. faced a significant blow as it was stripped of its top-tier sovereign debt rating by Fitch, being downgraded from AAA to AA+. The soaring fiscal deficit and continuous clashes over the debt ceiling were highlighted as major concerns.

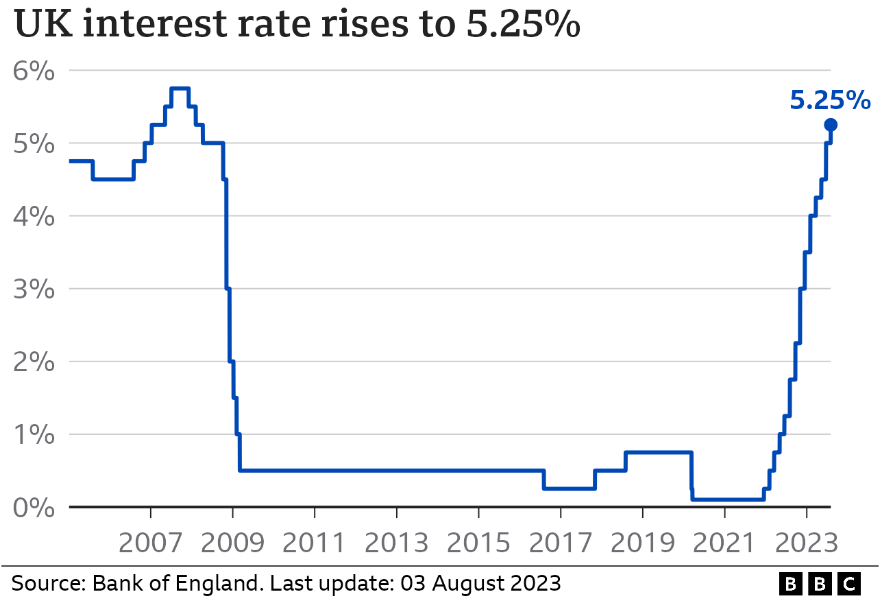

Bank of England’s Interest Rate Dynamics

The Bank of England took a bold step by raising interest rates by 0.25 percentage points, marking the highest level since 2008. Projections hint at a possible rate peak below 5.75%, implying two more hikes to conclude the current tightening phase. However, even following market expectations, it might take until mid-2025 for inflation to reach the bank’s 2% target.

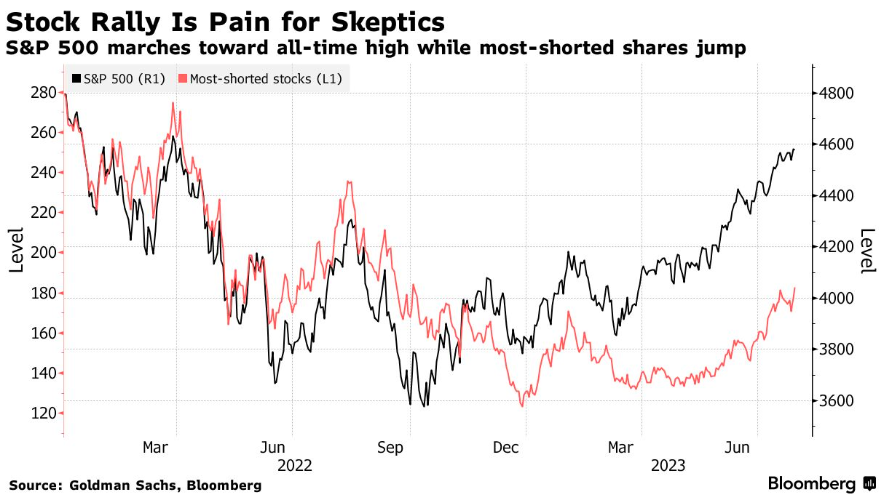

Equity World: Hedge Funds Retreat in 2023’s Complex Markets

The convoluted markets of 2023 have caused long-short hedge funds to de-risk their books. Stock-picking hedge funds are beginning to weigh the risks against gains and are pulling back. Major firms such as JPMorgan, Morgan Stanley and Goldman Sachs observed a pattern of risk reduction, particularly in de-grossing activities.

Despite challenges, the S&P 500 has ascended 28% since October, except for two months. This equity rally, although favourable for long positions, has created hurdles for hedge funds’ short positions.

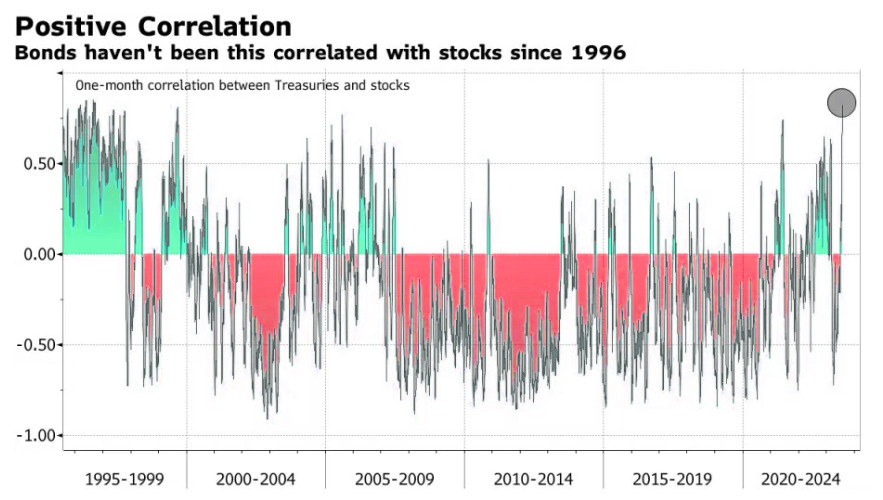

Bonds: Treasuries’ Worst Performance Since the 1990s

Treasuries are currently showcasing their most dismal performance as a stock hedge since the 1990s. The traditional role of Treasuries as a rally-point when stocks fall is shifting. The correlation between the Bloomberg US Treasury Total Return Index and the S&P 500 reached 0.82 last week, signifying an almost synchronised movement. This change commenced with the Fed’s rate hike to fight inflation, affecting both the fixed-income and equity markets.

Source: Bloomberg

Earnings Recap: Tech Sector Shines in Q2

With 84% of the S&P 500 having disclosed their Q2 earnings, a whopping 79% reported above estimates. This milestone also signifies the highest percentage of S&P 500 companies with positive earnings surprises since Q3 2021. This phenomenon has been particularly pronounced in the tech sector, with almost all tech companies exceeding their earnings expectations.

The global markets continue to navigate through an intricate landscape filled with monetary policy adjustments, inflation concerns, equity movements and bonds’ changing dynamics. The lessons of the past week and the careful navigation of present trends offer invaluable insights for investors, policymakers and market watchers. Understanding these dimensions will be crucial in shaping future investment strategies and economic policies. The future remains cautiously optimistic, yet full of potential opportunities for those equipped with knowledge and foresight.

FAQs

Q1: What is the current outlook on global inflation?

The global market is closely watching inflation data, especially readings from major economies like China and the United States. There are concerns about whether meeting expectations might disappoint investors, given the surprise dip in U.S. CPI last month.

Q2: How are UK house prices performing in the current economic climate?

According to Halifax data, UK house prices fell for the fourth consecutive month in July. Despite economic challenges, the housing market continues to show resilience.

Q3: What changes have occurred in the Eurozone and Chinese economies?

The Eurozone economy returned to growth in the second quarter and core inflation remained elevated. In contrast, China’s manufacturing sector contracted in July, indicating a loss of momentum in the world’s second-largest economy.

Q4: What was the significant downgrade that the U.S. experienced recently?

The U.S. was downgraded from its AAA sovereign debt rating to AA+ by Fitch, citing concerns over the ballooning fiscal deficit and governance issues related to the debt ceiling.

Q5: What actions has the Bank of England taken regarding interest rates?

The Bank of England raised interest rates by a quarter of a percentage point, taking them to their highest level since 2008. Future interest rate hikes are expected as part of the current tightening cycle.

Q6: What trends are being observed in the equity markets in 2023?

In 2023’s complex markets, long-short hedge funds are de-risking their books, and stock-picking hedge funds are retreating as risks outweigh potential gains. There has also been a substantial rise in the S&P 500.

Q7: What has been happening with Treasuries as a stock hedge?

Treasuries are exhibiting their worst performance as a stock hedge since the 1990s. There’s a change in their traditional role, with bonds and stocks moving almost in sync, affecting investment strategies.

Q8: How did the tech sector perform in Q2 earnings?

The tech sector excelled in Q2, with almost all tech companies beating their earnings expectations. It played a significant part in 79% of S&P 500 companies reporting positive earnings surprises.

Q9: What is the current status of the global market?

The global market is navigating through intricate landscapes, including monetary policy adjustments, inflation, equity movements and changing dynamics in bonds. Careful observation and understanding of these dimensions will be vital for investors and policymakers.

Q10: Where can I find more information about the global markets?

You can subscribe to our newsletter to stay current with global markets. You can also book a free discovery call to discuss your financial circumstances in detail with our experts.

Schedule Your Personalised Consultation Today!

Ready to take the next step towards achieving your financial goals? Schedule a call with one of our expert advisers today! Our team are here to provide guidance based on your unique financial situation and help you make the most of the insights gained from our resources. Don’t miss out on the opportunity to receive professional advice and tailored strategies. Take action now and let us guide you towards a brighter financial future.

Discover Market Insights!

Are you eager to make informed and strategic investment decisions? Look no further! Visit our Market Analysis page now to gain exclusive access to expert insights, trends, and data that can help shape your investment journey.

Access Our Financial Calculators!

Take control of your financial future with our comprehensive suite of Financial Calculators. Whether you’re planning for retirement, considering a mortgage, or exploring investment opportunities, our powerful tools can provide valuable insights to guide your decisions.

Disclaimer: The information provided on this website is for general informational purposes only and does not constitute financial or investment advice. The content on this website should not be considered as a recommendation or offer to buy or sell any securities or financial instruments. Investing in securities involves risks, and past performance is not indicative of future results. The value of an investment may fall as well as rise. You may get back less than the amount invested. Any reliance you place on such information is strictly at your own risk. The commentary provided should not be taken as financial advice as it does not take your financial circumstances into consideration and does not provide an objective view with your requirements in mind. The views are our opinions at the time of writing and may change based on incoming information. The data shared may be incorrect or out-dated at the time of reading. Our opinions are subject to change without notice and we are not under any obligation to update or keep this information current. The views expressed may no longer be current and may have already been acted upon. Tax treatment depends on individual circumstances and all tax rules may change in the future. The information contained on this page has been prepared using all reasonable care. However, it is not guaranteed as to its accuracy, and it is published solely for information purposes.