Last week saw a continued decline in equity markets driven by inflation data that strongly suggests the possibility of additional FOMC interest rate hikes. The combination of steady CPI, hotter-than-expected PPI figures and rising oil prices indicates a potential acceleration in inflation, which could prompt the FOMC to implement not just one, but possibly two or more rate hikes. This sentiment weighed on the S&P 500, causing it to drop by about half a percent and hit a one-month low, signaling a potential impact on consumer demand.

Key Events for the Week

This week, the release of FOMC minutes on Wednesday is expected to be a significant event influencing global markets. Investors will be keenly observing the minutes for insights into the direction FOMC members, who voted to resume rate hikes earlier, might lean for the upcoming September meeting. The Reserve Bank of New Zealand is also expected to maintain its current policy on Wednesday, reflecting the stance taken in their July meeting.

Global Economic Indicators

Tuesday’s Australian wage price index, projected to accelerate further, could significantly affect the Reserve Bank of Australia’s decisions in their next meeting. The UK’s wage growth in Tuesday’s labour market report and Wednesday’s CPI figures will shape expectations for the Bank of England, which has been consistently raising rates. Canada’s CPI figures on Tuesday will similarly impact the Bank of Canada’s decision-making, especially after recent rate hikes.

Forex and Intervention Possibilities

The Yen’s breach of 145 against the dollar has raised speculations about potential BOJ intervention. HSBC predicts potential resistance within the 145-148 range, recalling the Japanese government and BOJ’s previous intervention at the 145 level in September 2022.

UK Economic Landscape

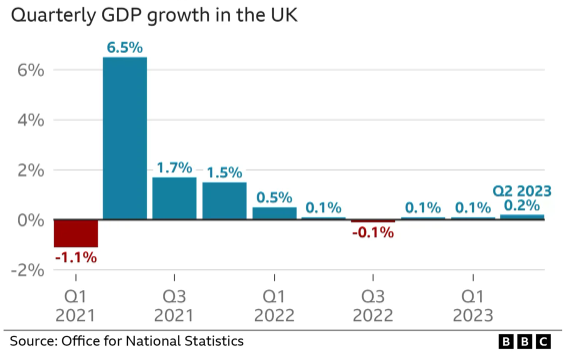

The UK economy defied expectations of second-quarter stagnation with a resilient 0.2% quarterly growth, driven by favourable weather and robust manufacturing expansion. However, this surprising momentum has raised concerns about rising prices and wages, potentially supporting higher interest rates. The Bank of England’s prediction of stronger Q3 growth contrasts with signals pointing to a slowdown, making this week’s inflation data crucial for the ongoing discussion.

Employment and Wage Inflation

While unemployment in the UK has risen modestly since the start of the year, at 4%, it remains historically low. However, the labour market is still around 1% smaller than pre-pandemic levels, due in part to long-term sickness. In contrast, wage inflation remains elevated since 2021, driven by pandemic-induced distortions. Forecasts suggest that unemployment will remain steady, while wage inflation, currently at 6.9%, could potentially breach the 7% mark.

UK Inflation and Market Implications

Expectations point to a cooling of UK inflation to 6.7% in July, partly attributed to the energy price cap reduction. This development could signal a potential end to interest rate rises, even though swap markets suggest otherwise. However, this doesn’t necessarily imply an immediate shift to rate cuts, given the sustained elevation of consumer price growth.

China’s Property Sector and Global Markets

China’s property sector has once again raised concerns, causing Asian indices to drop as Country Garden suspended trading in certain onshore bonds. This scenario echoes the Evergrande crisis of 2021 and has started the week for global markets in a risk-off environment.

Hedge Funds’ Insights and Earnings Watch

Today, hedge funds are required to file 13F disclosures, revealing significant investments that can guide other investors. This information holds valuable insights into market trends. Earnings to watch this week include prominent retailers like Walmart, Cisco, Target, and Home Depot.

FAQs

1. What caused the decline in equity markets last week?

The decline in equity markets was primarily driven by inflation data that indicated the possibility of additional interest rate hikes by the FOMC. The combination of steady Consumer Price Index (CPI), higher-than-expected Producer Price Index (PPI), and rising oil prices contributed to concerns about potential inflation acceleration.

2. What is the significance of the FOMC minutes release this week?

The release of the FOMC minutes is a significant event as it provides insights into the thoughts and leanings of FOMC members who recently voted to resume rate hikes. This information can offer clues about the potential direction of the upcoming September meeting.

3. How did the UK economy perform in the second quarter?

Contrary to expectations of stagnation, the UK economy demonstrated resilience by achieving 0.2% quarterly growth in the second quarter. This growth was driven by factors like favourable weather and robust manufacturing expansion.

4. What impact did the Yen breaching 145 against the dollar have?

The breach of the Yen against the dollar to 145 raised speculations of potential intervention by the Bank of Japan (BOJ). HSBC’s prediction of resistance within the 145-148 range suggests possible market dynamics around this level.

5. What does the recent suspension of trading by Country Garden signify?

The suspension of trading in onshore bonds by Country Garden, a prominent Chinese property developer, has evoked memories of the Evergrande crisis in 2021. This development has led to a risk-off sentiment in global markets, particularly in the Asian indices.

6. How have long-short hedge funds reacted to current market conditions?

Long-short hedge funds have been derisking their portfolios amidst the complex market environment of 2023. These hedge funds have been reducing positions on both sides of their books, a process known as de-grossing, indicating a cautious approach due to potential risks outweighing potential gains.

7. What insights can be gained from hedge funds’ 13F disclosures?

Hedge funds’ 13F disclosures provide valuable insights into their significant investments. These insights can guide other investors in understanding current market trends and potential investment strategies.

8. What key earnings are expected this week?

Notable earnings to watch this week include those from major retailers such as Walmart, Cisco, Target, and Home Depot. These earnings reports can offer insights into the performance and outlook of the retail sector.

9. What are market expectations for central banks’ decisions in various countries?

The Reserve Bank of New Zealand and the Reserve Bank of Australia are both expected to maintain their current policies. The Bank of England, which has been raising rates, will be influenced by wage growth and inflation data. Similarly, Canada’s CPI figures will impact the Bank of Canada’s decisions.

10. How are Treasuries performing in relation to equity markets?

Treasuries are exhibiting their worst performance as a stock hedge since the 1990s. Traditionally, they serve as a hedge during stock market declines. However, the increasing correlation between Treasuries and the S&P 500 suggests a changing relationship due to factors like inflation concerns and the Fed’s rate hikes.

Schedule Your Personalised Consultation Today!

Ready to take the next step towards achieving your financial goals? Schedule a call with one of our expert advisers today! Our team are here to provide guidance based on your unique financial situation and help you make the most of the insights gained from our resources. Don’t miss out on the opportunity to receive professional advice and tailored strategies. Take action now and let us guide you towards a brighter financial future.

Discover Market Insights!

Are you eager to make informed and strategic investment decisions? Look no further! Visit our Market Analysis page now to gain exclusive access to expert insights, trends, and data that can help shape your investment journey.

Access Our Financial Calculators!

Take control of your financial future with our comprehensive suite of Financial Calculators. Whether you’re planning for retirement, considering a mortgage, or exploring investment opportunities, our powerful tools can provide valuable insights to guide your decisions.

Disclaimer: The information provided on this website is for general informational purposes only and does not constitute financial or investment advice. The content on this website should not be considered as a recommendation or offer to buy or sell any securities or financial instruments. Investing in securities involves risks, and past performance is not indicative of future results. The value of an investment may fall as well as rise. You may get back less than the amount invested. Any reliance you place on such information is strictly at your own risk. The commentary provided should not be taken as financial advice as it does not take your financial circumstances into consideration and does not provide an objective view with your requirements in mind. The views are our opinions at the time of writing and may change based on incoming information. The data shared may be incorrect or out-dated at the time of reading. Our opinions are subject to change without notice and we are not under any obligation to update or keep this information current. The views expressed may no longer be current and may have already been acted upon. Tax treatment depends on individual circumstances and all tax rules may change in the future. The information contained on this page has been prepared using all reasonable care. However, it is not guaranteed as to its accuracy, and it is published solely for information purposes.