Welcome to our weekly market update, where we provide insights into recent market movements and key economic developments to help guide your investment decisions. This week, we’ll delve into the latest trends in global markets, including notable events from the past week and what lies ahead.

Recent Market Highlights:

Nvidia Earnings Drive Market Exuberance

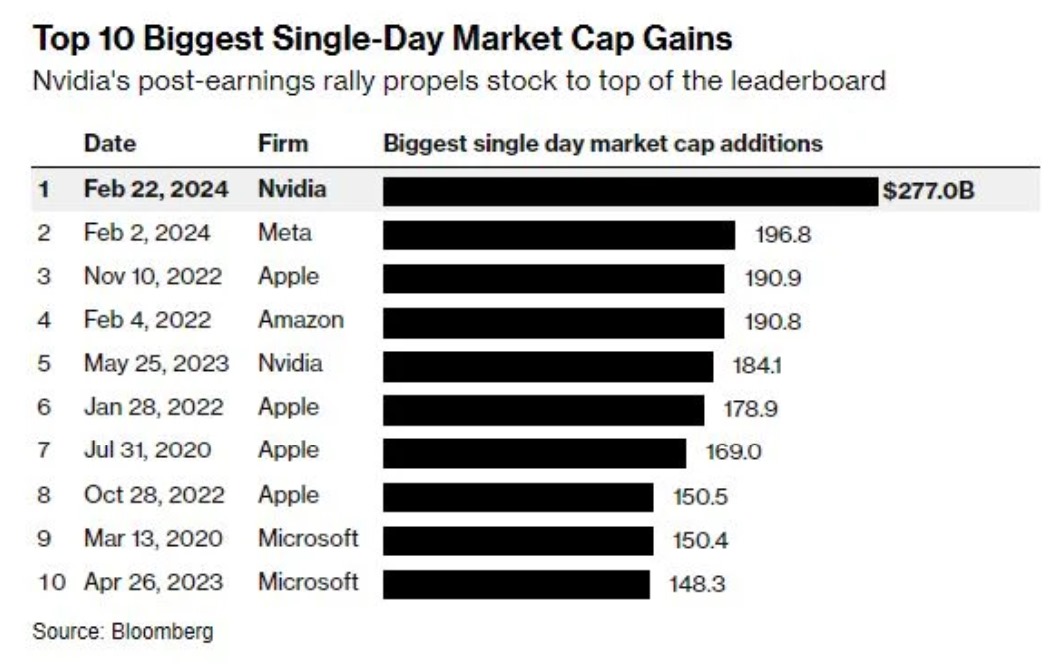

The anticipation surrounding Nvidia’s earnings report created volatility in the US stock market, with futures dipping ahead of the results. However, a dramatic turnaround occurred following Nvidia’s blockbuster earnings, leading to record highs in stock averages. Nvidia reported an EPS of $5.16, exceeding the forecasted $4.61, alongside actual revenue of $22.1 billion, outpacing the expected $20.55 billion. This earnings report had led Nvidia to reach the top of the biggest single day market capitalisation gains. This demonstrates the significance of key earnings reports in influencing market sentiment and direction.

Federal Reserve Pushes Back on Rate Cuts

Minutes from the Federal Reserve’s latest meeting revealed a cautious stance on early interest rate cuts, prompting a shift in market expectations. Investors now anticipate the first rate cut to occur in June, with four reductions expected for the year. This underscores the importance of monitoring central bank communications and policy decisions for insights into future market trends.

Mixed Global PMI Data

Flash PMI data from the US beat expectations, but UK and European data disappointed in places. Despite this, global equities rallied last week, reaching record levels in the US and Japan. This highlights the interconnectedness of global markets and the impact of economic indicators on investor sentiment.

BoE’s Response to Recession

Confirmation of Britain’s technical recession in late 2023 raised questions about the Bank of England’s monetary policy. While some argue for early rate cuts, others believe the recession is too mild to warrant immediate action. The Bank’s response to economic challenges will be closely watched by market participants for clues about future policy direction.

Looking Ahead:

1. Economic Data Releases

The week ahead will bring fresh data on new home sales, durable orders, and construction prices. Analysts are closely watching for inflationary signals following higher-than-expected CPI and PPI reports for January. These data points will provide insights into the health of the economy and potential shifts in monetary policy.

2. Central Bank Decisions

The Reserve Bank of New Zealand will announce its interest rate decision, while the focus remains on the Bank of England’s response to the recession and inflationary pressures. Central bank decisions and statements can significantly impact market sentiment and asset prices, making them crucial events for investors to monitor.

3. Market Outlook

Equity indices are poised for more all-time highs, supported by strong earnings and positive sentiment. However, ongoing volatility and economic uncertainties require investors to remain vigilant and adaptable. Diversification and disciplined investment strategies are key to navigating market fluctuations and achieving long-term financial goals.

Investment Strategies and Tips:

1. Diversification

Maintain a diversified portfolio across asset classes to mitigate risk and capture opportunities in different market conditions. Consider allocating assets to both traditional and alternative investments to enhance portfolio resilience.

2. Stay Informed

Keep abreast of market developments and economic indicators to make informed investment decisions. Regularly monitor news updates, market analyses, and expert opinions to stay ahead of market trends.

3. Monitor Central Bank Policies

Pay attention to central bank announcements and policy shifts, as they can impact market sentiment and asset prices. Stay informed about interest rate decisions, quantitative easing measures, and forward guidance provided by central banks.

4. Review Portfolio Regularly

Regularly review your investment portfolio to ensure it aligns with your financial goals and risk tolerance. Consider rebalancing if necessary to maintain your desired asset allocation and risk exposure.

As we navigate through uncertain times, it’s essential to remain focused on long-term investment objectives while being mindful of short-term market fluctuations. By staying informed, diversified, and disciplined, investors can position themselves for success in any market environment.

Note: Market conditions are subject to change, and this overview is based on information available at the time of writing.

Sources: Reuters, Bloomberg, CNBC and Financial Times

FAQs

1. What is the significance of Nvidia’s earnings report for the stock market?

Nvidia’s earnings report is significant because it provides insights into the performance of a leading semiconductor company and its impact on the broader technology sector. Positive earnings results from Nvidia can boost investor confidence and drive market sentiment, leading to potential gains in stock averages.

2. Why did the Federal Reserve push back on early rate cuts, and how did the market react?

The Federal Reserve pushed back on early rate cuts due to concerns about inflation and the need for further economic data to inform monetary policy decisions. The market initially reacted with volatility as investors adjusted their expectations, but ultimately rallied following Nvidia’s strong earnings report.

3. What factors contributed to the mixed global PMI data, and how did it affect market sentiment?

Mixed global PMI data resulted from varying economic conditions in different regions, with the US outperforming expectations while the UK and Europe faced challenges. Despite this, global equities rallied, indicating resilience in investor sentiment and optimism about economic recovery.

4. How is the Bank of England responding to Britain’s technical recession, and what are the implications for monetary policy?

The Bank of England is closely monitoring UK’s technical recession and its implications for inflation and economic growth. While some advocate for early rate cuts, others believe the recession is mild and may not warrant immediate action. The Bank’s response will influence market expectations for future monetary policy decisions.

5. What economic data releases and central bank decisions should investors watch for in the week ahead?

Investors should pay attention to data on new home sales, durable orders, and construction prices, as well as central bank decisions from the Reserve Bank of New Zealand and updates from the Bank of England. These events can impact market sentiment and asset prices, providing valuable insights for investors.

6. What investment strategies can investors employ to navigate market volatility and uncertainty?

Investors can employ diversification, staying informed, monitoring central bank policies, and regularly reviewing their portfolios to navigate market volatility and uncertainty. By maintaining a diversified portfolio, staying informed about market developments, and adjusting investment strategies as needed, investors can mitigate risk and capitalise on opportunities in changing market conditions.

If you have specific questions or concerns about your investments, don’t hesitate to reach out to our financial advisers for personalised guidance and recommendations.

Schedule Your Personalised Consultation Today!

Ready to take the next step towards achieving your financial goals? Schedule a call with one of our expert advisers today! Our team are here to provide guidance based on your unique financial situation and help you make the most of the insights gained from our resources. Don’t miss out on the opportunity to receive professional advice and tailored strategies. Take action now and let us guide you towards a brighter financial future.

Discover Market Insights!

Are you eager to make informed and strategic investment decisions? Look no further! Visit our Market Analysis page now to gain exclusive access to expert insights, trends, and data that can help shape your investment journey.

Access Our Financial Calculators!

Take control of your financial future with our comprehensive suite of Financial Calculators. Whether you’re planning for retirement, considering a mortgage, or exploring investment opportunities, our powerful tools can provide valuable insights to guide your decisions.

Disclaimer: The information provided on this website is for general informational purposes only and does not constitute financial or investment advice. The content on this website should not be considered as a recommendation or offer to buy or sell any securities or financial instruments. Investing in securities involves risks, and past performance is not indicative of future results. The value of an investment may fall as well as rise. You may get back less than the amount invested. Any reliance you place on such information is strictly at your own risk. The commentary provided should not be taken as financial advice as it does not take your financial circumstances into consideration and does not provide an objective view with your requirements in mind. The views are our opinions at the time of writing and may change based on incoming information. The data shared may be incorrect or out-dated at the time of reading. Our opinions are subject to change without notice and we are not under any obligation to update or keep this information current. The views expressed may no longer be current and may have already been acted upon. Tax treatment depends on individual circumstances and all tax rules may change in the future. The information contained on this page has been prepared using all reasonable care. However, it is not guaranteed as to its accuracy, and it is published solely for information purposes.