Welcome to our weekly market update, where we provide insights into recent market movements and key developments to help guide your wealth decisions. This week, we’ll delve into the latest trends in global markets, including notable events from the past week and what lies ahead.

As Chancellor Jeremy Hunt prepares to deliver the Spring Budget to Parliament this Wednesday, financial markets are bracing for potential impacts on various asset classes. The budget speech, scheduled for 12:30 GMT, is anticipated to be the last major economic update before the upcoming general election, making it a crucial event for investors to monitor closely.

Market Expectations and Investor Sentiment

Bond traders are closely watching for any indications of inflationary pressures, particularly if the Chancellor opts to introduce pre-election giveaways. Equity investors, on the other hand, are focused on sectors such as homebuilders, retail, and leisure companies, especially if measures like the stamp duty cut are made permanent.

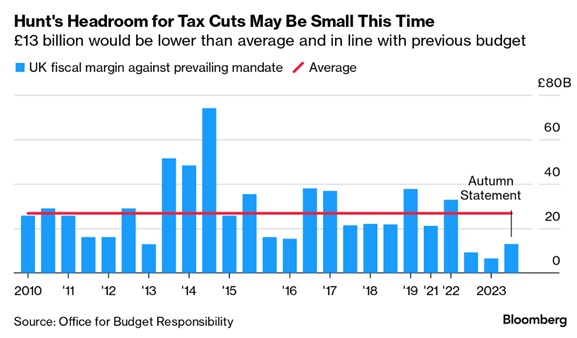

However, Chancellor Hunt has sought to manage expectations by emphasising prudence and responsibility in the budget announcement. With fiscal room limited, significant tax cuts seem unlikely, as cautioned by financial experts and institutions like the Office of Budget Responsibility and the International Monetary Fund. It is important to note, the conservative party are looking for smaller, targeted measures to appease voters ahead of the election.

Market Reaction and Economic Indicators

Last week, the market experienced relief as the Personal Consumption Expenditures (PCE) deflator report aligned with economists’ consensus estimates. Concerns about inflation were mitigated, although the month-over-month increase signalled a potential upward trend, particularly driven by rising service prices.

Investors are closely monitoring the PCE, which is considered the Federal Reserve’s preferred inflation gauge. This could influence the Fed’s future monetary policy decisions, potentially leading to higher interest rates over an extended period.

The market trend continues to favour equity indices, with upward momentum persisting, especially in the US market. However, there are concerns about a possible melt-up scenario fuelled by a handful of high-performing stocks, such as Nvidia.

Asset Class Performance

Commodity currencies struggled to capitalise on a weakened US Dollar, despite a rise in oil prices. Precious metals, particularly gold, showed resilience and closed higher amid data misses and market uncertainty.

Equity markets remained strong, with shallow dips indicating persistent bullish sentiment. Meanwhile, bonds attempted to break support levels but faced resistance, reflecting ongoing market indecision.

Outlook and Key Insights

Looking ahead, investors are advised to closely monitor central bank decisions and macroeconomic data releases. With the Bank of Canada and the European Central Bank interest rate decisions on the horizon, along with key employment reports from the US and Canada, market volatility may increase.

In conclusion, while the Spring Budget announcement will undoubtedly impact financial markets, investors should maintain a diversified portfolio and stay informed about evolving market dynamics. As always, prudent risk management and long-term investment strategies remain essential in navigating uncertain market conditions.

Note: Market conditions are subject to change, and this overview is based on information available at the time of writing.

Sources: Reuters, Bloomberg, CNBC and Financial Times

FAQs

1. What is the Spring Budget?

The Spring Budget is an annual statement delivered by the Chancellor of the Exchequer to Parliament, outlining the government’s taxation and spending plans for the upcoming fiscal year.

2. When is the Spring Budget announced?

The Spring Budget is typically presented to Parliament in March, although the exact date may vary from year to year. In 2024, Chancellor Jeremy Hunt is set to deliver the budget speech on Wednesday.

3. What are investors expecting from the Spring Budget?

Investors are closely watching for any announcements related to taxation, spending, and economic policies that could impact various asset classes. They are particularly interested in measures that could affect sectors like homebuilding, retail and leisure.

4. How might the Spring Budget affect financial markets?

The budget announcement can influence market sentiment and asset prices, especially if there are unexpected policy changes or initiatives that impact investor confidence. Bond yields, equity indices, currency exchange rates and commodity prices may all react to the budget news.

5. What should investors do to prepare for the Spring Budget?

Investors should stay informed about the latest developments leading up to the budget announcement and be prepared to adjust their portfolios accordingly. It’s important to diversify investments, stay updated on economic indicators, and consider consulting with a financial adviser for personalised guidance.

6. How can I stay updated on the implications of the Spring Budget for my investments?

You can stay informed by following reputable financial news sources, attending market briefings or webinars, and engaging with financial professionals who provide insights and analysis on the implications of the budget for various asset classes.

7. What are the potential risks associated with the budget announcement?

Risks could include unexpected policy changes, volatility in financial markets, and uncertainty about the economic outlook. Investors should be prepared for potential market fluctuations and consider implementing risk management strategies to protect their investments.

8. How does the Spring Budget tie into broader economic trends and forecasts?

The budget is closely linked to broader economic trends and forecasts, including inflation rates, GDP growth projections and employment data. Investors should consider the budget announcement in the context of these factors to gain a comprehensive understanding of its potential impact on financial markets.

9. What are some key indicators to watch following the Spring Budget?

Key indicators to monitor include central bank decisions, macroeconomic data releases (such as employment reports and inflation figures), and sector-specific developments that could be influenced by budget policies. These indicators can provide valuable insights into market trends and investment opportunities.

10. How can I incorporate the implications of the Spring Budget into my investment strategy?

Investors can incorporate budget-related insights into their investment strategy by conducting thorough research, diversifying their portfolios, and staying disciplined in their approach. It’s essential to remain focused on long-term goals and to adapt to changing market conditions as needed.

If you have specific questions or concerns about your investments, don’t hesitate to reach out to our financial advisers for personalised guidance and recommendations.

Schedule Your Personalised Consultation Today!

Ready to take the next step towards achieving your financial goals? Schedule a call with one of our expert advisers today! Our team are here to provide guidance based on your unique financial situation and help you make the most of the insights gained from our resources. Don’t miss out on the opportunity to receive professional advice and tailored strategies. Take action now and let us guide you towards a brighter financial future.

Discover Market Insights!

Are you eager to make informed and strategic investment decisions? Look no further! Visit our Market Analysis page now to gain exclusive access to expert insights, trends, and data that can help shape your investment journey.

Access Our Financial Calculators!

Take control of your financial future with our comprehensive suite of Financial Calculators. Whether you’re planning for retirement, considering a mortgage, or exploring investment opportunities, our powerful tools can provide valuable insights to guide your decisions.

Disclaimer: The information provided on this website is for general informational purposes only and does not constitute financial or investment advice. The content on this website should not be considered as a recommendation or offer to buy or sell any securities or financial instruments. Investing in securities involves risks, and past performance is not indicative of future results. The value of an investment may fall as well as rise. You may get back less than the amount invested. Any reliance you place on such information is strictly at your own risk. The commentary provided should not be taken as financial advice as it does not take your financial circumstances into consideration and does not provide an objective view with your requirements in mind. The views are our opinions at the time of writing and may change based on incoming information. The data shared may be incorrect or out-dated at the time of reading. Our opinions are subject to change without notice and we are not under any obligation to update or keep this information current. The views expressed may no longer be current and may have already been acted upon. Tax treatment depends on individual circumstances and all tax rules may change in the future. The information contained on this page has been prepared using all reasonable care. However, it is not guaranteed as to its accuracy, and it is published solely for information purposes.