As we reflect on the events of the past week in the financial markets, it becomes apparent that the prevailing trends have persisted without any pronounced shifts. While equity indices didn’t manage to extend their positive streak, they also didn’t exhibit any significant signs of weakness, suggesting a resilient stance despite various headwinds.

Equities had been showing promise throughout the week until the release of the Friday NFPs (Non-Farm Payrolls), which, while strong, didn’t propel markets further upward. The subsequent retreat of both the S&P500 and the DAX to close the week nearly flat underscores the cautious sentiment prevailing among investors. Bonds, however, continued to hold firm, failing to break support levels yet again, which fuelled a decline in yields across the board, contributing to the ongoing risk rally.

The US Dollar finally broke its period of stagnation, albeit in an unfavorable direction. Despite the NFP headline surpassing expectations, concerns over rising unemployment rates and other economic indicators hinting at potential contraction weighed heavily on the currency. Conversely, the Euro experienced gains following the rate decision, buoyed by lingering hawkish sentiments within the ECB, though the specter of an impending rate cut looms on the horizon.

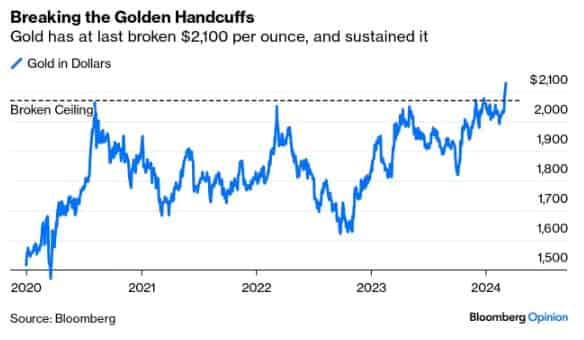

In the realm of precious metals, last week marked a bullish turn, with Gold surging to new all-time highs. This surge was supported by a confluence of factors, including speculation of Fed easing, geopolitical tensions, increased central bank buying, and a weakened dollar. While Gold’s inherent unpredictability remains a factor, its low correlation with mainstream assets such as bonds and equities suggests its potential as a valuable diversification tool within investment portfolios.

Turning our attention to macroeconomic developments, the focus was on the US payroll numbers, which painted a mixed picture for February. While the headline figure boasted a robust gain, downward revisions to previous months and a rise in the unemployment rate tempered enthusiasm. Fed Chair Jerome Powell’s bi-annual testimony to Congress echoed the sentiment of likely rate cuts later in the year, contingent upon inflation and growth metrics. Similarly, the ECB hinted at potential rate cuts in June, aligning with market expectations.

In the United Kingdom, the Chancellor’s budget measures aimed to provide a stimulus to the economy, including a reduction in the National Insurance rate and incentives for investing in UK shares. Despite recent challenges, UK stocks remain relatively undervalued compared to other developed markets, with the current price/earnings ratio reflecting a significant discount.

Lastly, the Magnificent Seven index, once touted for its outperformance, witnessed a decline last week, primarily led by notable names like Tesla and Apple. These companies faced challenges, particularly in China, contributing to the index’s downturn. Looking ahead, market sentiment remains cautiously optimistic, with upcoming US CPI readings poised to potentially impact the ongoing risk rally and Dollar weakness.

Note: Market conditions are subject to change, and this overview is based on information available at the time of writing.

Sources: Reuters, Bloomberg, CNBC and Financial Times

FAQs

1. What are the key takeaways from the recent market trends?

The market continues to show resilience despite various challenges, with equities maintaining stability and bonds holding firm.

2. What factors influenced the performance of the US Dollar?

Concerns over rising unemployment rates and economic indicators pointing towards potential contraction weighed on the US Dollar, leading to movement in its value.

3. Why did precious metals, particularly Gold, experience a surge in value?

Several factors, including speculation of Fed easing, geopolitical tensions, increased central bank buying, and a weakened dollar, contributed to the bullish turn in precious metals.

4. What were the highlights of the recent macroeconomic developments?

The US payroll numbers painted a mixed picture for February, with a robust headline gain but downward revisions to previous months. Additionally, statements from Fed Chair Jerome Powell hinted at potential rate cuts later in the year.

5. How did the UK budget measures impact the market?

The Chancellor’s budget measures aimed to stimulate the UK economy, including a reduction in the National Insurance rate and incentives for investing in UK shares.

6. What led to the decline in the Magnificent Seven index?

Companies within the index, such as Tesla and Apple, faced challenges, particularly in China, contributing to the index’s downturn.

7. What upcoming events could impact market sentiment?

The upcoming US CPI readings are poised to potentially impact the ongoing risk rally and Dollar weakness.

If you have specific questions or concerns about your investments, don’t hesitate to reach out to our financial advisers for personalised guidance and recommendations.

Schedule Your Personalised Consultation Today!

Ready to take the next step towards achieving your financial goals? Schedule a call with one of our expert advisers today! Our team are here to provide guidance based on your unique financial situation and help you make the most of the insights gained from our resources. Don’t miss out on the opportunity to receive professional advice and tailored strategies. Take action now and let us guide you towards a brighter financial future.

Discover Market Insights!

Are you eager to make informed and strategic investment decisions? Look no further! Visit our Market Analysis page now to gain exclusive access to expert insights, trends, and data that can help shape your investment journey.

Access Our Financial Calculators!

Take control of your financial future with our comprehensive suite of Financial Calculators. Whether you’re planning for retirement, considering a mortgage, or exploring investment opportunities, our powerful tools can provide valuable insights to guide your decisions.

Disclaimer: The information provided on this website is for general informational purposes only and does not constitute financial or investment advice. The content on this website should not be considered as a recommendation or offer to buy or sell any securities or financial instruments. Investing in securities involves risks, and past performance is not indicative of future results. The value of an investment may fall as well as rise. You may get back less than the amount invested. Any reliance you place on such information is strictly at your own risk. The commentary provided should not be taken as financial advice as it does not take your financial circumstances into consideration and does not provide an objective view with your requirements in mind. The views are our opinions at the time of writing and may change based on incoming information. The data shared may be incorrect or out-dated at the time of reading. Our opinions are subject to change without notice and we are not under any obligation to update or keep this information current. The views expressed may no longer be current and may have already been acted upon. Tax treatment depends on individual circumstances and all tax rules may change in the future. The information contained on this page has been prepared using all reasonable care. However, it is not guaranteed as to its accuracy, and it is published solely for information purposes.