In the ever-evolving landscape of global financial markets, staying informed and adaptable is essential for investors seeking to navigate volatility and capitalise on opportunities. Last week witnessed significant movements across various asset classes, driven by a multitude of factors including inflation data surprises, central bank actions, and economic indicators. As we prepare for the week ahead, let’s delve deeper into recent developments and explore actionable insights to guide investment decisions.

Inflationary Pressures and Central Bank Policy

Inflation remains a predominant concern, particularly in the United States, where recent data releases have underscored the persistent warmth in consumer and producer prices. Both the Consumer Price Index (CPI) and the Producer Price Index (PPI) outpaced expectations, fuelling speculation about the Federal Reserve’s future monetary policy decisions.

All eyes are now on the upcoming Federal Open Market Committee (FOMC) meeting, scheduled for this Wednesday. While market consensus suggests no immediate rate cuts, investors are closely monitoring the FOMC’s statement and commentary for clues regarding the central bank’s stance on inflation and potential policy adjustments. A nuanced shift towards a more accommodative stance could trigger a bullish response in equities, particularly the S&P 500, as investors interpret it as supportive of continued economic growth.

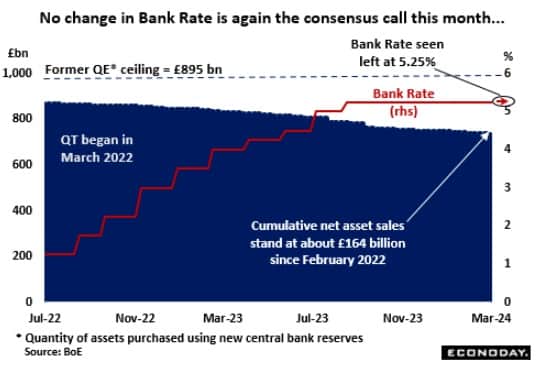

In addition to the FOMC meeting, other central banks, including the Bank of England (BoE) and the Bank of Japan (BoJ), are set to announce their policy decisions this week. While the BoE is expected to maintain its Bank Rate, speculation abounds regarding the BoJ’s potential departure from its longstanding negative interest rate policy. Any signals from these central banks regarding policy adjustments could reverberate across global markets, impacting investor sentiment and asset prices.

Market Recap: Key Highlights from Last Week

Reviewing the performance of major global markets provides valuable insights into prevailing trends and investor sentiment. In the United States, major indices such as the S&P 500 and the Dow Jones Industrial Average experienced mixed movements amid concerns over inflationary pressures and signs of moderating consumer spending. Energy stocks emerged as outperformers, buoyed by surging oil prices, while technology shares faced headwinds amid sector-specific challenges.

Meanwhile, in Europe, encouraging corporate earnings and anticipation of potential ECB rate cuts fuelled gains in major stock indexes, including Germany’s DAX and France’s CAC 40. Despite economic headwinds, the UK economy exhibited signs of resilience, with GDP expanding in January despite a rise in unemployment rates.

Asia-Pacific markets witnessed varied performances, with Japanese stocks facing pressure amidst uncertainty surrounding the BoJ’s policy direction. In Australia, strong US economic data releases contributed to market volatility, with the S&P ASX 200 Index experiencing declines.

Looking Ahead: Key Events and Considerations

As we look ahead to the week’s events, several pivotal releases and announcements are poised to influence market dynamics and investor sentiment. Central bank decisions, including those from the BoJ, FOMC, BoE, and RBA, will be closely scrutinised for insights into future monetary policy directions. Moreover, macroeconomic data releases, such as Flash Manufacturing and Services PMI, CPI reports, and GDP figures, will offer valuable insights into regional economic health and growth prospects.

Strategies for Investors

In navigating the complexities of today’s financial markets, adopting a diversified and informed investment approach is paramount. Here are some strategies to consider:

1. Stay Informed: Keep abreast of key economic indicators, central bank announcements, and geopolitical developments to make well-informed investment decisions.

2. Diversification: Spread investments across different asset classes and geographic regions to mitigate risk and capture opportunities in diverse market conditions.

3. Long-Term Perspective: Maintain a focus on long-term financial goals and avoid reactionary decisions based on short-term market fluctuations.

4. Risk Management: Implement risk management strategies such as stop-loss orders and asset allocation rebalancing to protect capital and optimise returns.

5. Seek Professional Guidance: Consider consulting our qualified financial advisers to tailor investment strategies to individual risk tolerance, financial objectives, and time horizon.

By staying vigilant, disciplined, and proactive, investors can position themselves to navigate potential opportunities and challenges successfully in the week ahead. While market volatility may persist, informed decision-making and a long-term investment mindset can pave the way for sustainable financial growth and resilience in uncertain times.

Note: Market conditions are subject to change, and this overview is based on information available at the time of writing.

Sources: Reuters, Bloomberg, CNBC and Financial Times

FAQs

1. Why is inflation such a significant concern for investors?

Inflation erodes purchasing power over time, impacting both consumers and investors. For investors, inflation can diminish the real returns on their investments, particularly in fixed-income assets like bonds. Additionally, high inflation rates can lead to uncertainty in the market, affecting investor sentiment and asset prices.

2. How do central bank decisions impact financial markets?

Central banks play a pivotal role in shaping monetary policy, which influences interest rates, inflation, and overall economic conditions. Decisions made by central banks, such as changes in interest rates or asset purchase programs, can have significant implications for bond yields, currency exchange rates, and equity valuations, thereby impacting various asset classes and investor portfolios.

3. What are the potential consequences of rising bond yields?

Rising bond yields can have several ramifications for financial markets. Firstly, they can lead to a decline in bond prices, impacting bondholders’ portfolios. Additionally, higher bond yields can attract investors away from equities, as they seek higher returns from fixed-income investments. Moreover, rising yields may signal expectations of future interest rate hikes by central banks, potentially affecting borrowing costs for businesses and consumers.

4. How should investors approach market volatility?

Market volatility is an inherent feature of financial markets and can present both risks and opportunities for investors. It’s essential for investors to maintain a diversified portfolio, as different asset classes may perform differently during periods of volatility. Additionally, staying informed about market developments, adhering to a long-term investment strategy, and avoiding impulsive decisions can help investors navigate through market fluctuations with resilience.

5. What factors should investors consider when crafting an investment strategy?

Investors should consider several factors when formulating an investment strategy, including their risk tolerance, investment objectives, time horizon, and market outlook. It’s crucial to diversify investments across various asset classes and geographic regions to mitigate risk and capture opportunities in diverse market conditions. Additionally, staying informed about macroeconomic trends, company fundamentals, and geopolitical events can aid in making informed investment decisions.

If you have specific questions or concerns about your investments, don’t hesitate to reach out to our financial advisers for personalised guidance and recommendations.

Schedule Your Personalised Consultation Today!

Ready to take the next step towards achieving your financial goals? Schedule a call with one of our expert advisers today! Our team are here to provide guidance based on your unique financial situation and help you make the most of the insights gained from our resources. Don’t miss out on the opportunity to receive professional advice and tailored strategies. Take action now and let us guide you towards a brighter financial future.

Discover Market Insights!

Are you eager to make informed and strategic investment decisions? Look no further! Visit our Market Analysis page now to gain exclusive access to expert insights, trends, and data that can help shape your investment journey.

Access Our Financial Calculators!

Take control of your financial future with our comprehensive suite of Financial Calculators. Whether you’re planning for retirement, considering a mortgage, or exploring investment opportunities, our powerful tools can provide valuable insights to guide your decisions.

Disclaimer: The information provided on this website is for general informational purposes only and does not constitute financial or investment advice. The content on this website should not be considered as a recommendation or offer to buy or sell any securities or financial instruments. Investing in securities involves risks, and past performance is not indicative of future results. The value of an investment may fall as well as rise. You may get back less than the amount invested. Any reliance you place on such information is strictly at your own risk. The commentary provided should not be taken as financial advice as it does not take your financial circumstances into consideration and does not provide an objective view with your requirements in mind. The views are our opinions at the time of writing and may change based on incoming information. The data shared may be incorrect or out-dated at the time of reading. Our opinions are subject to change without notice and we are not under any obligation to update or keep this information current. The views expressed may no longer be current and may have already been acted upon. Tax treatment depends on individual circumstances and all tax rules may change in the future. The information contained on this page has been prepared using all reasonable care. However, it is not guaranteed as to its accuracy, and it is published solely for information purposes.