The coming week’s UK inflation data could be pivotal in determining whether the Bank of England (BoE) will implement a rate cut in June. Currently, market sentiment suggests a 58% probability of such an action. As the BoE prepares for its first rate cut, Wednesday’s inflation data will be crucial in deciding whether the cut comes in June or is postponed until August.

Inflation Data on the Horizon

The previous overall inflation rate stood at 3.2%, but it is anticipated to fall close to the BoE’s 2% target. This reduction can largely be attributed to the significant 12% drop in household electricity and gas bills observed at the start of April, a trend expected to continue into July. Additionally, services inflation, which was at 6.0%, is forecasted to dip to 5.5% in April’s data. The consensus expects a slightly lower figure of 5.4%. Minor deviations from these expectations are unlikely to significantly alter the BoE’s course.

While another set of inflation data will be released just before June’s meeting, there is less uncertainty surrounding those figures. BoE Governor Andrew Bailey, who has recently shown a dovish stance, indicated that the data need only align roughly with forecasts to justify a near-term rate cut. Should the data meet expectations, a June rate cut could become the base case. However, a higher-than-expected inflation figure could push the rate cut decision to August, given the committee’s visible division on the matter.

Labour Market Indicators

Key labour market indicators also support the possibility of a rate cut in June. The annual rate of pay growth, excluding bonuses, remained unchanged at 6% for the three months through March, slightly higher than forecast. In the private sector, regular pay growth was 5.9%, marginally below the BoE’s expectations. The labour market appears to be loosening, with the unemployment rate rising to 4.3% and job openings declining for the 22nd consecutive month. These data points tentatively support a reduction in interest rates, as a transition to a looser labour market seems to be underway. However, policymakers may exercise caution and await additional data before making a final decision on easing rates.

Fiscal Dynamics

On the fiscal front, cuts to National Insurance, wage increases, and lower expected borrowing costs are being offset by a higher tax burden. Tax cuts appear increasingly out of reach, and the National Institute of Economic and Social Research suggests that a new government will likely need to raise taxes. This fiscal environment adds another layer of complexity to the BoE’s decision-making process.

Global Market Movements

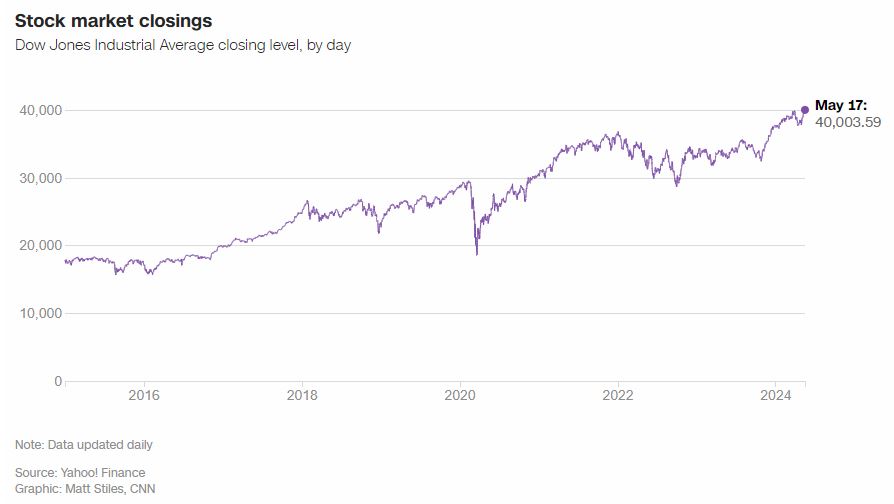

Last week, a risk-on environment prevailed, with the MSCI All Country World Index rising 1.7% (10.3% year-to-date). In the US, the S&P 500 Index ended 1.6% higher (11.8% YTD), climbing to a record high during the week. The Dow Jones Industrial Average crossed the 40,000 threshold for the first time (image above), and the Nasdaq Composite Index rallied 2.2% (11.5% YTD). As concerns over inflation and interest rates appeared to dissipate, growth stocks outperformed.

In Europe, the MSCI Europe ex UK advanced 0.6% (10.5% YTD). However, cautious comments from ECB members tempered optimism about potential monetary policy easing. Major European stock indexes were mixed: Germany’s DAX Index lost 0.4% (11.7% YTD), France’s CAC 40 Index decreased 0.4% (10.1% YTD), but Italy’s FTSE MIB Index gained 2.1% (19.1% YTD). Switzerland’s SMI Index surged 2.7% (11.3% YTD). In the UK, the FTSE 100 Index firmed 0.1% (10.8% YTD), and the FTSE 250 Index added 0.6% (6.8% YTD).

Japanese equities finished the week higher, with the TOPIX Index gaining 0.6% (17.3% YTD). This was despite economic weakness and a range-bound yen, influenced by expectations of US interest rate cuts and tentative hawkishness from the BoJ. Japanese Government Bond (JGB) yields also rose modestly.

Commodities Spotlight

Copper, gold, and silver prices surged to record highs in Asian trade on Monday, with silver crossing $30 an ounce. Gold’s 18% YTD rally is attributed to Chinese buying, geopolitical tensions, and expectations of falling US interest rates. Copper prices are soaring due to China’s efforts to revive its struggling property market, including $1 trillion in funding for affordable housing. Traders are scrambling to source physical copper to cover large short positions in futures markets, driving up trading volumes.

Key Economic Events Ahead

This week’s key economic events include UK and Japanese inflation data and the monthly flash purchasing managers index (PMI) readings. Renewed geopolitical tensions in the Middle East are drawing increased attention to the commodity market, further influencing investor sentiment.

As we approach a potentially decisive moment for the Bank of England and the broader markets, staying informed and agile is crucial. The upcoming data releases and policy decisions will undoubtedly shape the financial landscape in the weeks and months ahead.

Note: Market conditions are subject to change, and this overview is based on information available at the time of writing. The information provided in this article is for educational purposes only and does not constitute investment advice. Past performance is not indicative of future results.

Sources: Reuters, Bloomberg, CNBC and Financial Times

FAQs

1. Why is the upcoming UK inflation data so important?

The upcoming UK inflation data is critical because it will determine whether the Bank of England (BoE) will cut interest rates in June or delay the decision until August. The inflation figures will indicate if price pressures are easing sufficiently for the BoE to justify a rate cut.

2. What is the current market expectation for the Bank of England’s rate cut?

As of now, markets are pricing a 58% chance that the BoE will cut rates in June. The final decision will heavily depend on the inflation data released this week.

3. How has overall inflation been trending in the UK?

Overall inflation, previously at 3.2%, is expected to fall close to the BoE’s 2% target. This decline is partly due to a significant drop in household electricity and gas bills that began in April.

4. What is the expected change in services inflation?

Services inflation, which was at 6.0%, is forecasted to dip to 5.5% in April’s data. The consensus among analysts is slightly lower at 5.4%.

5. How does the labour market data influence the BoE’s decision?

Labour market data, including the annual rate of pay growth and unemployment rate, suggests a transition to a looser labour market. The annual rate of pay growth, excluding bonuses, remained unchanged at 6%, while the unemployment rate rose to 4.3%. These factors support the case for a rate cut, as they indicate easing wage pressures and a softening labour market.

6. What fiscal factors are affecting the UK economy?

On the fiscal front, cuts to National Insurance, wage increases, and lower expected borrowing costs are being balanced by a higher tax burden. The National Institute of Economic and Social Research suggests that the new government may need to raise taxes, further influencing economic conditions.

7. How have global markets been performing recently?

Global markets have seen a risk-on environment. The MSCI All Country World Index rose 1.7%, and in the US, the S&P 500 Index ended 1.6% higher, reaching record highs. European markets were mixed, with cautious comments from ECB members tempering optimism.

8. What is happening with commodity prices?

Commodity prices, particularly copper, gold, and silver, have surged to record highs. Factors driving these increases include Chinese buying, geopolitical tensions, and expectations of falling US interest rates. Copper prices are notably rising due to China’s efforts to support its property market.

9. What are the key economic events to watch this week?

This week, key economic events include UK and Japanese inflation data and the monthly flash purchasing managers index (PMI) readings. Additionally, renewed geopolitical tensions in the Middle East are impacting the commodity market.

10. What could delay the BoE’s rate cut decision to August?

A higher-than-expected inflation figure this week could delay the BoE’s rate cut decision to August, given the visible division among committee members. Significant deviations from expected inflation figures would prompt the BoE to reassess the timing of the rate cut.

11. How might geopolitical tensions affect the markets?

Renewed geopolitical tensions in the Middle East are drawing increased attention to the commodity markets, potentially influencing investor sentiment and market volatility.

If you have specific questions or concerns about your investments, don’t hesitate to reach out to our financial advisers for personalised guidance and recommendations.

Schedule Your Personalised Consultation Today!

Ready to take the next step towards achieving your financial goals? Schedule a call with one of our expert advisers today! Our team are here to provide guidance based on your unique financial situation and help you make the most of the insights gained from our resources. Don’t miss out on the opportunity to receive professional advice and tailored strategies. Take action now and let us guide you towards a brighter financial future.

Discover Market Insights!

Are you eager to make informed and strategic investment decisions? Look no further! Visit our Market Analysis page now to gain exclusive access to expert insights, trends, and data that can help shape your investment journey.

Access Our Financial Calculators!

Take control of your financial future with our comprehensive suite of Financial Calculators. Whether you’re planning for retirement, considering a mortgage, or exploring investment opportunities, our powerful tools can provide valuable insights to guide your decisions.

Disclaimer: The information provided on this website is for general informational purposes only and does not constitute financial or investment advice. The content on this website should not be considered as a recommendation or offer to buy or sell any securities or financial instruments. Investing in securities involves risks, and past performance is not indicative of future results. The value of an investment may fall as well as rise. You may get back less than the amount invested. Any reliance you place on such information is strictly at your own risk. The commentary provided should not be taken as financial advice as it does not take your financial circumstances into consideration and does not provide an objective view with your requirements in mind. The views are our opinions at the time of writing and may change based on incoming information. The data shared may be incorrect or out-dated at the time of reading. Our opinions are subject to change without notice and we are not under any obligation to update or keep this information current. The views expressed may no longer be current and may have already been acted upon. Tax treatment depends on individual circumstances and all tax rules may change in the future. The information contained on this page has been prepared using all reasonable care. However, it is not guaranteed as to its accuracy, and it is published solely for information purposes.