Over the past year, the Bank of England has taken decisive action by raising interest rates 13 times since December 2021. This series of rate hikes aims to address the persistent issue of soaring price rises, which have fuelled concerns about inflationary pressure. By making borrowing more expensive, the central bank hopes to curb consumer spending and cool down price increases.

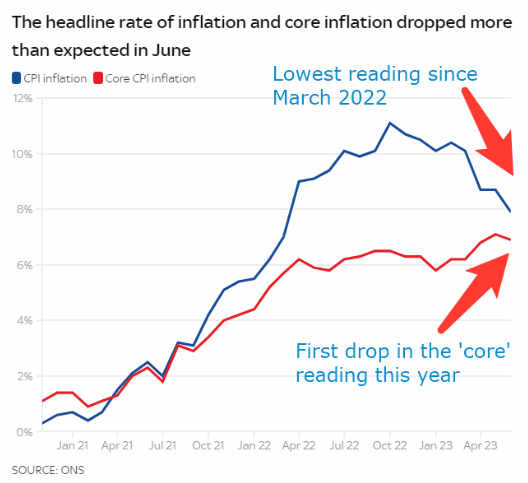

The UK’s most recent inflation report brings some positive news, as the figures came in better than estimated. Inflation stands at 7.9%, a decrease from the previous month’s 8.7%, marking its lowest level in over a year. Core inflation, which excludes food and fuel prices, experienced its first decline this year, dropping to 6.9%. The slowdown in June can be attributed to falling fuel prices, while food prices have been rising at a slower pace, according to the Office for National Statistics (ONS), the entity responsible for publishing these figures.

As a result of these developments, markets have adjusted their expectations, now pricing in a 60-70% probability of the Bank of England raising interest rates by a smaller margin of 25 basis points (bps) in the upcoming month. However, it is essential to note that the UK’s inflation rate remains almost four times higher than the central bank’s official 2% target and significantly surpasses the inflation rates of other developed countries. In comparison, the United States has an inflation rate of 3%, while the Eurozone reports an inflation rate of 5.5%.

While the recent decline in inflation suggests some catch-up with other similar countries, it is worth emphasizing that the UK still faces the possibility of having the highest inflation rate among G7 nations. There is still a considerable gap to bridge. Furthermore, recent statements from Bank of England policymakers indicate their reluctance to deviate from their path of increasing interest rates. Deputy Governor Ramsden, for instance, has stated that inflation remains “much too high.”

The focus now lies not on whether the Bank of England will hike rates but rather on the magnitude of the anticipated increase. Market expectations suggest that interest rates may peak at 6%, reflecting the market’s projection for the future path of monetary policy.

In summary, the Bank of England’s successive rate hikes demonstrate its commitment to addressing inflationary pressure in the UK. The recent inflation report shows some encouraging signs, with inflation figures coming in lower than expected. However, the UK’s inflation rate remains significantly above the central bank’s target and that of other developed nations. As markets anticipate further rate hikes, the focus shifts to the extent of these increases. The path to curbing inflation and stabilizing the economy lies ahead, with the Bank of England striving to strike a balance between economic growth and price stability.

FAQs

1. Why has the Bank of England raised interest rates multiple times in recent months?

The Bank of England has raised interest rates to combat rising inflationary pressures by making borrowing more expensive. This measure aims to reduce consumer spending and alleviate price increases.

2. How did the UK’s most recent inflation report fare compared to expectations?

The UK’s most recent inflation report was better than estimated, with inflation standing at 7.9%—a decrease from the previous month’s 8.7%. Core inflation, which excludes food and fuel prices, also experienced its first decline of the year, dropping to 6.9%.

3. What is the market’s current expectation for the Bank of England’s next interest rate hike?

Markets are currently pricing in a 60-70% probability that the Bank of England will raise interest rates by a smaller margin of 25 basis points (bps) in the upcoming month.

4. How does the UK’s inflation rate compare to other developed countries?

The UK’s inflation rate is almost four times higher than the Bank of England’s official 2% target and significantly surpasses the inflation rates of other developed countries. The United States has an inflation rate of 3%, while the Eurozone reports an inflation rate of 5.5%.

5. What is the projected peak for UK interest rates according to market expectations?

Market expectations suggest that UK interest rates may peak at 6%, reflecting the market’s outlook on the future path of monetary policy.

Schedule Your Personalised Consultation Today!

Ready to take the next step towards achieving your financial goals? Schedule a call with one of our expert advisers today! Our team are here to provide guidance based on your unique financial situation and help you make the most of the insights gained from our resources. Don’t miss out on the opportunity to receive professional advice and tailored strategies. Take action now and let us guide you towards a brighter financial future.

Discover Market Insights!

Are you eager to make informed and strategic investment decisions? Look no further! Visit our Market Analysis page now to gain exclusive access to expert insights, trends, and data that can help shape your investment journey.

Access Our Financial Calculators!

Take control of your financial future with our comprehensive suite of Financial Calculators. Whether you’re planning for retirement, considering a mortgage, or exploring investment opportunities, our powerful tools can provide valuable insights to guide your decisions.

Disclaimer: The information provided on this website is for general informational purposes only and does not constitute financial or investment advice. The content on this website should not be considered as a recommendation or offer to buy or sell any securities or financial instruments. Investing in securities involves risks, and past performance is not indicative of future results. The value of an investment may fall as well as rise. You may get back less than the amount invested. Any reliance you place on such information is strictly at your own risk. The commentary provided should not be taken as financial advice as it does not take your financial circumstances into consideration and does not provide an objective view with your requirements in mind. The views are our opinions at the time of writing and may change based on incoming information. The data shared may be incorrect or out-dated at the time of reading. Our opinions are subject to change without notice and we are not under any obligation to update or keep this information current. The views expressed may no longer be current and may have already been acted upon. Tax treatment depends on individual circumstances and all tax rules may change in the future. The information contained on this page has been prepared using all reasonable care. However, it is not guaranteed as to its accuracy, and it is published solely for information purposes.