Last week was marked by turbulence across global financial markets, with various geopolitical tensions and inflation concerns driving investor sentiment. As a financial adviser, it’s crucial to understand the nuances of these developments and strategise accordingly to safeguard and grow your investments.

Global Market Overview

In the United States, the S&P 500 Index experienced a 1.5% downturn, primarily attributed to escalating tensions in the Middle East and persistent inflation pressures. Notably, growth stocks outperformed value shares amidst rising long-term Treasury yields. Meanwhile, small-cap stocks faced substantial declines, emphasizing the importance of diversification within investment portfolios.

European markets mirrored the cautious sentiment, with major indexes retreating modestly. Germany’s DAX Index, France’s CAC 40 Index, and Italy’s FTSE MIB Index all registered losses, albeit moderate ones. The euro depreciated against the US dollar, reflecting the prevailing risk-off sentiment.

Contrary to the global trend, the UK’s FTSE 100 Index exhibited resilience, buoyed by the pound’s depreciation against the dollar. Multinational companies within the index benefitted from enhanced competitiveness in international markets.

In Japan, stocks rallied, supported by a weakening yen and investors’ anticipation of government intervention to stabilize the currency. The TOPIX Index and TOPIX Small Index both posted gains, underlining the importance of monitoring currency movements in global investing.

Meanwhile, Australian markets edged up slightly, constrained by expectations of reduced rate cuts from central banks. The Australian dollar retreated against the US dollar, indicating currency volatility amid evolving market dynamics.

Geopolitical Concerns and Market Response

Heightened tensions in the Middle East, particularly involving Iran and Israel, triggered a flight to safety among investors. News of an Iranian strike on Israel intensified market anxieties, prompting a surge in safe-haven assets such as gold and the US dollar. Despite geopolitical risks, interest rates remained a primary market focus, with the Japanese yen weakening against the dollar to a 30-year low.

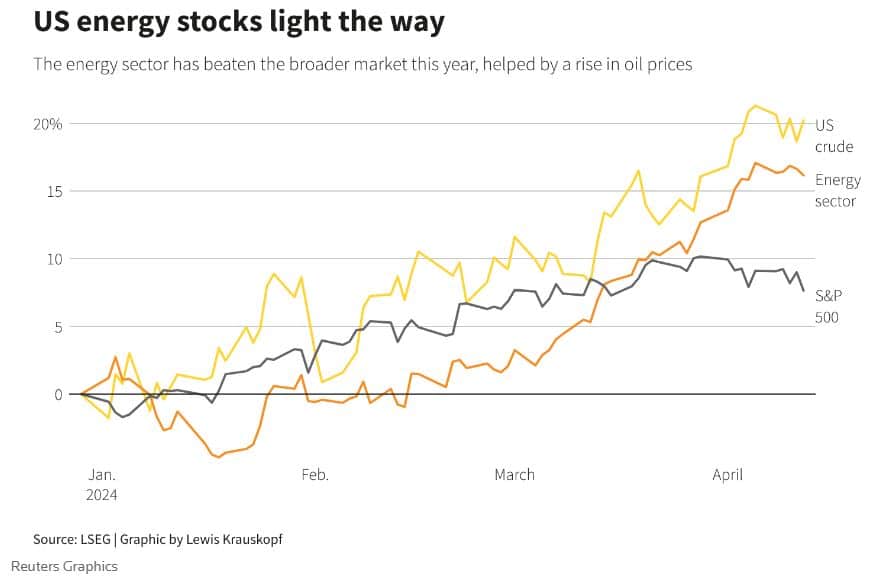

Oil prices initially dipped in response to perceived Iranian retaliation risks being priced in, but uncertainty persisted. The volatility index remained elevated, reflecting market nervousness and the potential for further oil price increases to exacerbate inflationary pressures.

Navigating Market Uncertainty: Tips for Investors

1. Diversify Your Portfolio: Spread your investments across different asset classes, geographies, and sectors to mitigate risk and enhance long-term returns.

2. Stay Informed: Monitor global developments, economic indicators, and geopolitical events to make informed investment decisions. Knowledge is your best defense against market volatility.

3. Focus on Fundamentals: Rather than reacting impulsively to short-term fluctuations, maintain a focus on the underlying fundamentals of your investments. Quality companies with strong financials tend to weather market storms more effectively.

4. Review Your Asset Allocation: Regularly review your portfolio’s asset allocation to ensure it aligns with your financial goals, risk tolerance, and time horizon. Adjustments may be necessary in response to changing market conditions.

5. Seek Professional Guidance: Consult with our qualified financial advisers to develop a personalised investment strategy tailored to your individual circumstances and objectives.

In conclusion, while market volatility may present challenges, it also offers opportunities for strategic investors. By adopting a disciplined approach, staying informed, and leveraging expert advice, you can navigate uncertain times and position yourself for long-term financial success.

Note: Market conditions are subject to change, and this overview is based on information available at the time of writing.

Sources: Reuters, Bloomberg, CNBC and Financial Times

FAQs

1. What causes market volatility?

Market volatility can be triggered by various factors, including geopolitical tensions, economic data releases, corporate earnings reports, central bank policy announcements, and unexpected events such as natural disasters or pandemics. Investor sentiment and perceptions of risk also play significant roles in driving market fluctuations.

2. How should I respond to market volatility?

It’s essential to maintain a long-term perspective and avoid making impulsive decisions based on short-term fluctuations. Diversifying your investment portfolio, staying informed about market developments, and focusing on the fundamentals of your investments can help you navigate volatility effectively.

3. Is it possible to predict market movements accurately?

While some investors attempt to predict market movements, it’s important to recognise that the future direction of markets is inherently uncertain. Instead of trying to time the market, focus on building a well-diversified portfolio aligned with your financial goals and risk tolerance.

4. What are safe-haven assets, and why do investors turn to them during times of volatility?

Safe-haven assets, such as gold, US Treasury bonds, and certain currencies like the US dollar and Swiss franc, are considered relatively stable and less susceptible to market fluctuations. Investors often seek refuge in these assets during periods of heightened uncertainty or risk aversion.

5. How can I protect my investments during market downturns?

One way to protect your investments during market downturns is through diversification. By spreading your investments across different asset classes, geographies, and sectors, you can reduce the impact of volatility on your portfolio. Additionally, maintaining a cash reserve for emergencies and having a long-term investment horizon can help ride out temporary market fluctuations.

6. Should I make changes to my investment strategy during periods of volatility?

Making significant changes to your investment strategy in response to short-term volatility may not be advisable. Instead, focus on sticking to your long-term investment plan and rebalancing your portfolio as needed to maintain your desired asset allocation.

7. How can I take advantage of opportunities presented by market volatility?

Market volatility can create opportunities for savvy investors to buy high-quality assets at discounted prices. Consider using pound-cost averaging to gradually invest funds over time, taking advantage of lower prices during market downturns. However, be mindful of your risk tolerance and investment objectives when capitalising on market opportunities.

8. What role do economic indicators play in assessing market risk?

Economic indicators, such as GDP growth, inflation rates, unemployment figures, and consumer spending data, provide insights into the health of the economy and can influence market sentiment. Understanding how these indicators impact various asset classes can help investors gauge market risk and make informed decisions.

If you have specific questions or concerns about your investments, don’t hesitate to reach out to our financial advisers for personalised guidance and recommendations.

Schedule Your Personalised Consultation Today!

Ready to take the next step towards achieving your financial goals? Schedule a call with one of our expert advisers today! Our team are here to provide guidance based on your unique financial situation and help you make the most of the insights gained from our resources. Don’t miss out on the opportunity to receive professional advice and tailored strategies. Take action now and let us guide you towards a brighter financial future.

Discover Market Insights!

Are you eager to make informed and strategic investment decisions? Look no further! Visit our Market Analysis page now to gain exclusive access to expert insights, trends, and data that can help shape your investment journey.

Access Our Financial Calculators!

Take control of your financial future with our comprehensive suite of Financial Calculators. Whether you’re planning for retirement, considering a mortgage, or exploring investment opportunities, our powerful tools can provide valuable insights to guide your decisions.

Disclaimer: The information provided on this website is for general informational purposes only and does not constitute financial or investment advice. The content on this website should not be considered as a recommendation or offer to buy or sell any securities or financial instruments. Investing in securities involves risks, and past performance is not indicative of future results. The value of an investment may fall as well as rise. You may get back less than the amount invested. Any reliance you place on such information is strictly at your own risk. The commentary provided should not be taken as financial advice as it does not take your financial circumstances into consideration and does not provide an objective view with your requirements in mind. The views are our opinions at the time of writing and may change based on incoming information. The data shared may be incorrect or out-dated at the time of reading. Our opinions are subject to change without notice and we are not under any obligation to update or keep this information current. The views expressed may no longer be current and may have already been acted upon. Tax treatment depends on individual circumstances and all tax rules may change in the future. The information contained on this page has been prepared using all reasonable care. However, it is not guaranteed as to its accuracy, and it is published solely for information purposes.