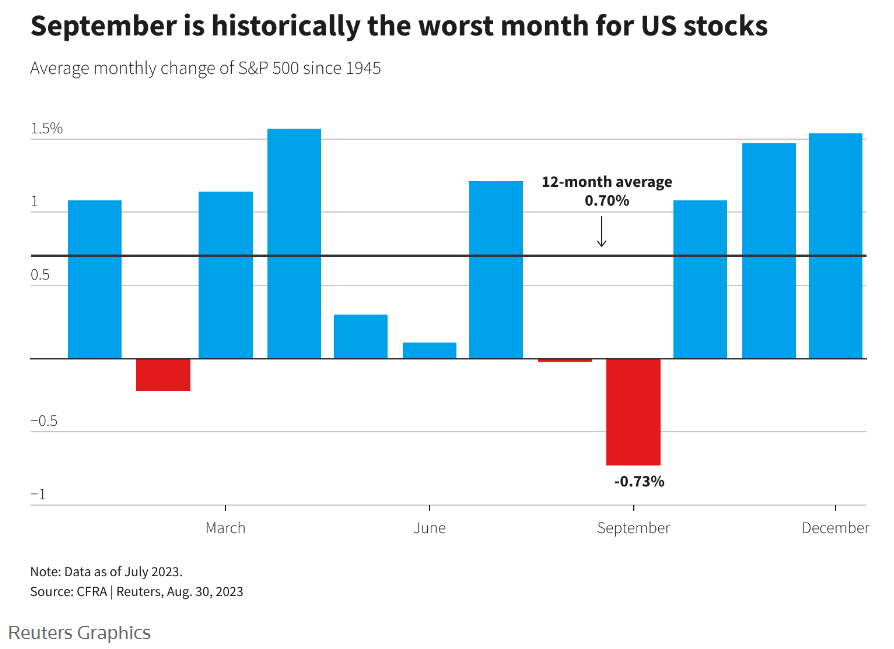

As we transition from a muted August to a historically turbulent September, the markets seem to be pausing to catch their breath. August marked a momentary halt in the five-month streak of market strength, with notable dips in the SPY and QQQ indices compared to July’s lows. As we embark on the potentially challenging month of September, investors are questioning whether the historical trend of weakness will hold true this year.

Assessing Last Week’s Data Releases

The previous week was a whirlwind of crucial data releases that had investors on their toes. Key data points included US inflation, GDP growth, and payrolls – all of which significantly impact market sentiment. However, the data presented a mixed picture, contributing to the growing market uncertainty about the Federal Reserve’s future rate decisions.

Friday’s payroll report, revealing a rise in the unemployment rate, suggests a nuanced scenario for the US economy. This scenario involves the restraint of wage growth, which could ultimately alleviate the pressure on inflation. The job market’s dynamics, closely tied to the central bank’s policy considerations, remain a focal point for market analysis.

Euro’s Struggle and Pound’s Sideways Movement

The Euro continued its recent trend of weakness, as German economic data consistently surprised to the downside. This weaker economic performance is influencing the Euro’s trajectory and adds to the global economic puzzle.

In the UK, the Pound has been in a consolidation phase, exhibiting limited movement against other major currencies. The FTSE, however, managed to rebound from its lows. Last week, the spotlight shone on comments made by the Bank of England’s Economist Pill, who hinted at the possibility of interest rates remaining higher for a prolonged period. These statements offer valuable insights into the central bank’s stance and its outlook on monetary policy.

Anticipating the Week Ahead

The upcoming week promises to be another critical juncture for markets as investors await further data points that will help shape the future rate path of both the Federal Reserve and the Bank of England. The market will closely monitor additional Purchasing Managers’ Index (PMI) readings, providing essential insights into economic activity trends. Additionally, the interest rate decisions from the Bank of Canada and the Reserve Bank of Australia (RBA) are anticipated to influence global market sentiment.

Oil Prices on the Rise

Amid these developments, oil prices have surged to nearly a year-high level. This rise in oil prices has implications for energy markets, macroeconomic dynamics, and inflation considerations. Investors will closely watch these movements for their potential impact on broader market trends.

Final Thoughts

As we navigate the intricate landscape of September, market participants are bracing themselves for the uncertainties that lie ahead. The mixed data releases from the past week underscore the delicate balance central banks are attempting to strike between economic growth and inflation management. By staying vigilant and informed about upcoming data releases, interest rate decisions, and global economic trends, investors can make well-informed decisions in this ever-evolving market environment.

Sources: Reuters, Bloomberg, CNBC, Financial Times

FAQs

1. Why is September historically considered a weak month for the markets?

September is often viewed as a challenging month for markets due to historical trends of increased market volatility and potential market corrections. Factors such as reduced trading volumes, portfolio adjustments, and heightened investor caution contribute to this perception.

2. What impact do mixed data releases have on market uncertainty?

Mixed data releases create uncertainty as they make it difficult for investors to predict the direction of economic indicators. When data points vary from expectations, it can lead to differing interpretations about the health of the economy and influence market sentiment.

3. How does the rise in the unemployment rate impact the market outlook?

An increase in the unemployment rate can have complex effects on the market. It might signal potential weakness in the labour market, which could prompt central banks to adopt more accommodative policies. However, it could also suggest that wage growth is being constrained, which might help alleviate concerns about inflation.

4. What role do central bank statements play in market movements?

Statements from central banks, like the Bank of England or the Federal Reserve, provide insights into their monetary policy decisions. These statements can influence investor sentiment, market expectations for interest rates, and overall market direction.

5. Why is the movement of oil prices significant for the markets?

Oil prices have a significant impact on various sectors, such as energy, transportation, and manufacturing. Changes in oil prices can affect production costs, inflation expectations, and consumer spending, thus influencing overall market sentiment.

6. What is the significance of PMI readings for economic analysis?

Purchasing Managers’ Index (PMI) readings offer a snapshot of economic activity in key sectors. They provide insights into trends such as business expansion or contraction, helping investors gauge the overall health of the economy and anticipate potential market shifts.

7. How does global economic data impact interest rate decisions?

Central banks often base their interest rate decisions on economic data, including inflation, GDP growth, and employment figures. Strong economic data might prompt central banks to consider raising interest rates to prevent overheating, while weak data could lead to accommodative measures.

8. Why are comments from central bank officials closely monitored by investors?

Comments from central bank officials, including hints about policy direction and economic outlook, can influence market expectations. Investors seek these insights to anticipate potential shifts in monetary policy and adjust their investment strategies accordingly.

9. How can investors navigate market uncertainties in September?

Investors can navigate uncertainties by staying informed about economic data releases, central bank communications, and global events. Diversification, prudent risk management, and consulting with financial advisers are strategies to consider during potentially turbulent times.

10. Is the information provided in this article investment advice?

No, the information provided in this article is for educational and informational purposes only. Always consult with a qualified financial adviser before making investment decisions, as individual circumstances vary.

Schedule Your Personalised Consultation Today!

Ready to take the next step towards achieving your financial goals? Schedule a call with one of our expert advisers today! Our team are here to provide guidance based on your unique financial situation and help you make the most of the insights gained from our resources. Don’t miss out on the opportunity to receive professional advice and tailored strategies. Take action now and let us guide you towards a brighter financial future.

Discover Market Insights!

Are you eager to make informed and strategic investment decisions? Look no further! Visit our Market Analysis page now to gain exclusive access to expert insights, trends, and data that can help shape your investment journey.

Access Our Financial Calculators!

Take control of your financial future with our comprehensive suite of Financial Calculators. Whether you’re planning for retirement, considering a mortgage, or exploring investment opportunities, our powerful tools can provide valuable insights to guide your decisions.

Disclaimer: The information provided on this website is for general informational purposes only and does not constitute financial or investment advice. The content on this website should not be considered as a recommendation or offer to buy or sell any securities or financial instruments. Investing in securities involves risks, and past performance is not indicative of future results. The value of an investment may fall as well as rise. You may get back less than the amount invested. Any reliance you place on such information is strictly at your own risk. The commentary provided should not be taken as financial advice as it does not take your financial circumstances into consideration and does not provide an objective view with your requirements in mind. The views are our opinions at the time of writing and may change based on incoming information. The data shared may be incorrect or out-dated at the time of reading. Our opinions are subject to change without notice and we are not under any obligation to update or keep this information current. The views expressed may no longer be current and may have already been acted upon. Tax treatment depends on individual circumstances and all tax rules may change in the future. The information contained on this page has been prepared using all reasonable care. However, it is not guaranteed as to its accuracy, and it is published solely for information purposes.