At the beginning of the week, market sentiment experiences a notable surge, propelled by a diverse array of factors. This article aims to dissect these elements comprehensively, shedding light on their individual contributions to the prevailing market sentiment.

Factors Affecting Market Sentiment

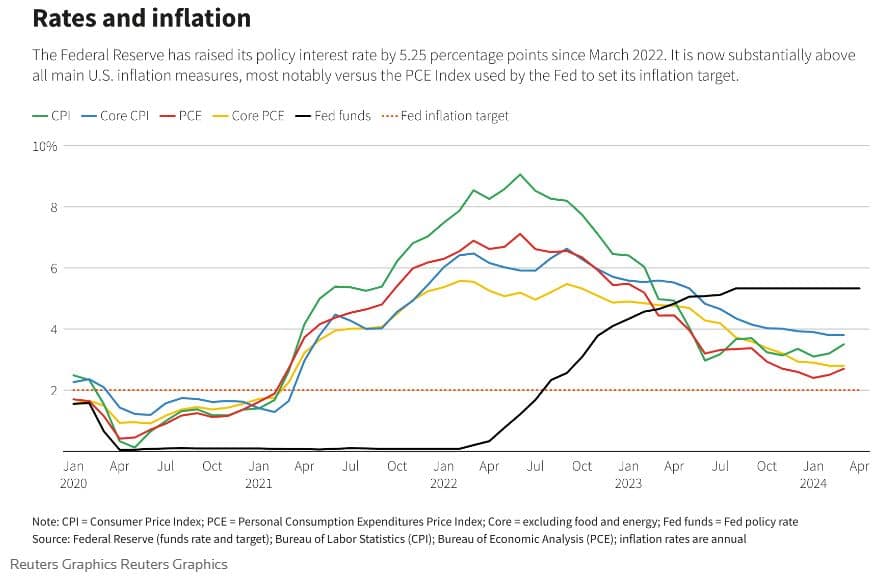

1. Inflationary Pressures in the US

The collective relief felt within the market ecosystem stems primarily from the realisation that inflationary pressures in the United States haven’t manifested as severely as initially anticipated. This realisation serves to assuage concerns surrounding the Federal Reserve’s monetary policy stance, particularly in relation to interest rate adjustments.

2. Middle East Ceasefire Hopes

Optimism pervades market sentiment as speculation swirls regarding the potential for a ceasefire agreement in the volatile Middle East region. Geopolitical tensions, often a source of market instability, appear poised for a potential de-escalation, fueling investor optimism.

3. Anticipation of Fed Meeting

Anticipation mounts ahead of the forthcoming Federal Reserve meeting, scheduled to convene on Tuesday. Market participants eagerly await insights from Governor Jerome Powell regarding the trajectory of interest rate adjustments and the central bank’s broader monetary policy outlook.

4. Impact of BoJ’s Decision

The Bank of Japan’s decision to maintain its dovish monetary policy stance exerts a tangible influence on currency markets, particularly evident in the valuation of the Japanese yen. The continuation of accommodative monetary measures underscores the yen’s depreciation against other major currencies.

5. US Economic Data

Recent economic data releases from the United States, including GDP figures and inflation metrics, serve as pivotal factors shaping market sentiment. Discrepancies between economic indicators and market expectations contribute to the dynamic landscape characterising current market sentiment.

Currency Market Analysis

The currency markets reflect the evolving sentiment, with discernible movements observed across major currency pairs. Notable fluctuations in exchange rates underscore the profound impact of prevailing market sentiment on currency valuations.

Oil and Precious Metals

Volatility remains a defining characteristic of oil prices, driven by a confluence of factors including supply dynamics, geopolitical tensions, and market speculation. Similarly, the correction observed in precious metal prices follows recent geopolitical uncertainties, marking a temporary adjustment within a broader bullish trend.

Equity Market Performance

Equity markets exhibit resilience in response to the prevailing sentiment, with indices rallying across the board. The performance of major indices underscores investor confidence in the underlying economic fundamentals and the outlook for corporate earnings.

Global Market Performance

Global markets demonstrate robust performance, with diverse regions witnessing positive momentum despite varying economic and geopolitical conditions. The resilience displayed by global markets reflects a collective optimism regarding the trajectory of key indicators and geopolitical developments.

The buoyant sentiment observed at the commencement of the week reflects a confluence of factors shaping the financial landscape. While uncertainties persist, market participants remain cautiously optimistic about the trajectory of key indicators and geopolitical developments.

Note: Market conditions are subject to change, and this overview is based on information available at the time of writing. The information provided in this article is for educational purposes only and does not constitute investment advice. Past performance is not indicative of future results.

Sources: Reuters, Bloomberg, CNBC and Financial Times

FAQs

1. What impact do geopolitical tensions have on market sentiment?

Geopolitical tensions introduce uncertainty, potentially dampening investor confidence and triggering market volatility as participants reassess risk dynamics.

2. How do central bank decisions influence currency markets?

Central bank decisions, particularly regarding interest rates and monetary policy, exert a significant influence on currency valuations, shaping exchange rate dynamics and market sentiment.

3. Why are commodity currencies correlated with risk sentiment?

Commodity currencies, such as the Australian and Canadian dollars, exhibit correlation with risk sentiment due to their sensitivity to global economic conditions, commodity prices, and market risk appetite.

4. What role does the Federal Reserve play in shaping market sentiment?

The Federal Reserve’s monetary policy decisions and communication regarding future policy actions play a crucial role in shaping market sentiment, influencing investor expectations and risk perceptions.

5. How do equity markets respond to changes in market sentiment?

Equity markets exhibit sensitivity to shifts in market sentiment, often experiencing rallies or corrections in response to changing investor perceptions of risk and opportunity.

If you have specific questions or concerns about your investments, don’t hesitate to reach out to our financial advisers for personalised guidance and recommendations.

Schedule Your Personalised Consultation Today!

Ready to take the next step towards achieving your financial goals? Schedule a call with one of our expert advisers today! Our team are here to provide guidance based on your unique financial situation and help you make the most of the insights gained from our resources. Don’t miss out on the opportunity to receive professional advice and tailored strategies. Take action now and let us guide you towards a brighter financial future.

Discover Market Insights!

Are you eager to make informed and strategic investment decisions? Look no further! Visit our Market Analysis page now to gain exclusive access to expert insights, trends, and data that can help shape your investment journey.

Access Our Financial Calculators!

Take control of your financial future with our comprehensive suite of Financial Calculators. Whether you’re planning for retirement, considering a mortgage, or exploring investment opportunities, our powerful tools can provide valuable insights to guide your decisions.

Disclaimer: The information provided on this website is for general informational purposes only and does not constitute financial or investment advice. The content on this website should not be considered as a recommendation or offer to buy or sell any securities or financial instruments. Investing in securities involves risks, and past performance is not indicative of future results. The value of an investment may fall as well as rise. You may get back less than the amount invested. Any reliance you place on such information is strictly at your own risk. The commentary provided should not be taken as financial advice as it does not take your financial circumstances into consideration and does not provide an objective view with your requirements in mind. The views are our opinions at the time of writing and may change based on incoming information. The data shared may be incorrect or out-dated at the time of reading. Our opinions are subject to change without notice and we are not under any obligation to update or keep this information current. The views expressed may no longer be current and may have already been acted upon. Tax treatment depends on individual circumstances and all tax rules may change in the future. The information contained on this page has been prepared using all reasonable care. However, it is not guaranteed as to its accuracy, and it is published solely for information purposes.