Jeremy Hunt announced the latest budget on the 6th of March, and it’s crucial to understand its impact on the UK economy. Here’s a breakdown of what’s been announced and what it means for you.

Positive Growth Outlook

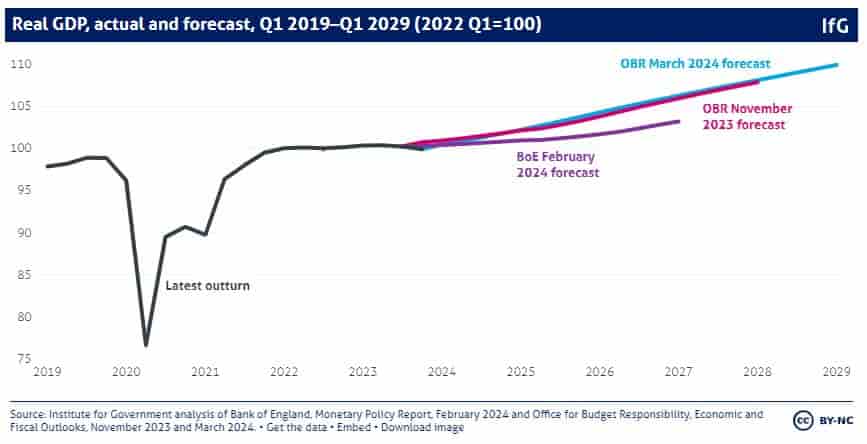

The Office for Budget Responsibility (OBR) has upgraded its growth forecast for 2024, showing a promising increase from 0.7% to 0.8%. This slight improvement is welcome news after the challenges faced in 2023, with a growth rate of just 0.3% and a technical recession. Looking ahead, the forecast predicts a gradual uptick with a growth rate of 1.9% in 2025.

Boosting the Economy

The budget includes measures designed to stimulate economic growth, such as cuts to national insurance and freezing fuel duty. These initiatives are expected to inject a short-term boost to demand by leaving more money in people’s pockets. Additionally, changes to high-income child benefit charges are set to enhance work incentives, contributing to a projected increase in GDP.

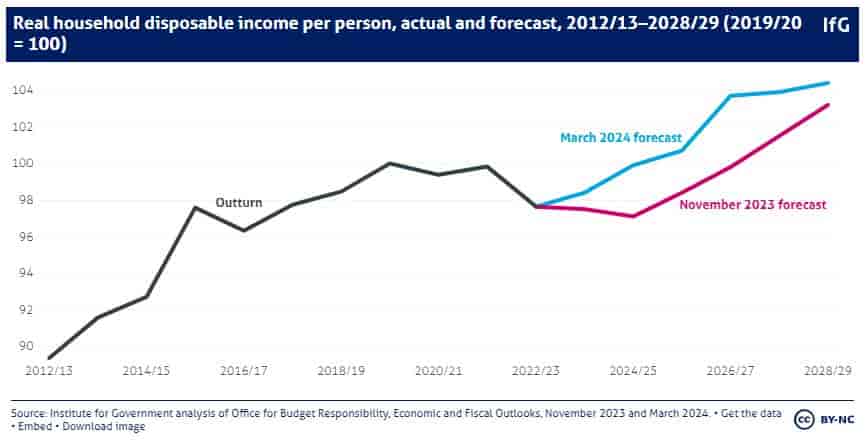

Household Income and Taxation

The Chancellor’s national insurance cut aims to increase post-tax incomes by around 0.5% on average, benefiting higher earners the most. However, other tax rises, including freezes to income tax and national insurance thresholds, may offset these gains over the forecast horizon.

Future Taxation and Economic Strategy

While the budget emphasizes tax cuts, it’s important to note that overall taxation is on the rise, reaching a post-war high due to decisions made over the past 14 years. There’s a call for a clear, long-term tax reform strategy to ensure stability and fairness in the tax system.

Critical Analysis of Tax Policies

The budget has drawn criticism for announcing significant tax changes without proper consultation or policy development. While some reforms aim to improve the tax system’s structure, there’s a need for more transparency and evidence-based decision-making in tax policy.

Fuel Duty Freeze

One notable announcement is the freeze on fuel duties for another year. While this provides immediate relief, future rises are planned, with duties set to increase by 5p a litre next March. Failure to implement these rises could pose challenges for the government’s fiscal targets.

Conclusion

Overall, the Spring Budget 2024 sets out ambitious plans to drive economic growth and support households. However, concerns remain about the long-term impact of taxation and the need for comprehensive tax reform. As the government navigates through economic challenges, transparency and evidence-based policymaking will be essential for building a resilient and prosperous future for all.

Here’s a summary of the main announcements from the recent budget:

Business Taxes:

- Value Added Tax (VAT) registration threshold is increasing from £85,000 to £90,000, with the deregistration threshold also rising.

- Full expensing extended to leased assets, subject to fiscal conditions.

- Recovery Loans Scheme extended until March 2026, renamed the Growth Guarantee Scheme.

- Empty property relief reset period extended.

- 40% relief on gross business rates bills introduced for eligible film studios until 2034.

- Independent Film Tax credit enhanced for films with production budgets below £15 million.

- Tax reliefs for theatres, orchestras, museums, and galleries permanently set at 45% for touring shows and 40% for non-touring shows from April 2025.

- Energy profits levy extended until March 2029, with provisions to remove it when prices normalise.

Personal Taxes:

- Employee National Insurance Contributions (NICs) to be reduced by 2% from April 2024.

- Self-employed NICs reduced to 6% from April 2024.

- Non-domiciled tax regime abolished from April 2025, with transitional arrangements.

- Capital Gains Tax on residential property reduced from 28% to 24% from April 2024.

- Furnished Holiday Lettings tax regime abolished from April 2025.

- Introduction of British Savings Bonds and a new British ISA.

- Changes to Inheritance Tax process from April 2024.

Duty Rates:

- Fuel Duty frozen.

- Alcohol Duty freeze extended.

- Introduction of duty on vaping from October 2026.

- Changes to Air Passenger Duty and Landfill Tax Rate.

- Abolition of Stamp Duty relief for those buying more than one property at a time from April 2025.

- Reduction of Capital Gains Tax on property from 28% to 24% from April 2024.

Other Announcements:

- Extension of Household Support Fund until September 2024.

- Child benefit reform including changes to high-income charge threshold and taper.

- Reform of child benefit to be based on household income from April 2026.

- Abolition of the £90 charge for Debt Relief Orders from April 2024.

Are you ready to take the next step toward securing your financial future? Whether you are leaning towards tax efficiency, investing, or a mix of both, our team at Tradenomic Financial are here to help you make the most of your hard-earned money. Schedule a free consultation with one of our experienced financial advisers today and let us guide you to financial peace of mind.

Frequently Asked Questions:

1. What is the Spring Budget 2024?

The Spring Budget 2024 is the latest financial plan presented by the Chancellor of the Exchequer, Jeremy Hunt, outlining the government’s spending, taxation, and economic policies for the upcoming year.

2. What are the key highlights of the Spring Budget 2024?

The budget includes measures aimed at stimulating economic growth, such as cuts to national insurance and freezing fuel duty. Additionally, there are reforms to high-income child benefit charges and other taxation policies.

3. How will the Spring Budget 2024 impact economic growth?

The budget forecasts a slight improvement in economic growth, with measures expected to boost GDP over the forecast period. However, concerns remain about the long-term impact of taxation and the need for comprehensive tax reform.

4. How will the Spring Budget 2024 affect household incomes?

The Chancellor’s national insurance cut is expected to increase post-tax incomes, particularly for higher earners. However, other tax rises may offset these gains over the forecast horizon.

5. What are the criticisms of the Spring Budget 2024?

Critics have raised concerns about significant tax changes being announced without proper consultation or policy development. There’s also a call for greater transparency and evidence-based decision-making in tax policy.

6. What is the future outlook for taxation and economic strategy?

While tax cuts are emphasised in the budget, overall taxation is on the rise. There’s a need for a clear, long-term tax reform strategy to ensure stability and fairness in the tax system.

7. How can individuals and businesses prepare for the changes outlined in the Spring Budget 2024?

It’s essential to stay informed about the budget’s implications and consult with our financial advisers to understand how the changes may affect personal or business finances. Additionally, monitoring updates from government sources can provide insights into any further developments related to budget measures.

Schedule Your Personalised Consultation!

Ready to take the next step towards achieving your financial goals?

Discover Market Insights!

Access Our Financial Calculators!

Disclaimer: The information provided on this website is for general informational purposes only and does not constitute financial or investment advice. The content on this website should not be considered as a recommendation or offer to buy or sell any securities or financial instruments. Investing in securities involves risks, and past performance is not indicative of future results. The value of an investment may fall as well as rise. You may get back less than the amount invested. Any reliance you place on such information is strictly at your own risk. The commentary provided should not be taken as financial advice as it does not take your financial circumstances into consideration and does not provide an objective view with your requirements in mind. The views are our opinions at the time of writing and may change based on incoming information. The data shared may be incorrect or out-dated at the time of reading. Our opinions are subject to change without notice and we are not under any obligation to update or keep this information current. The views expressed may no longer be current and may have already been acted upon. Tax treatment depends on individual circumstances and all tax rules may change in the future. The information contained on this page has been prepared using all reasonable care. However, it is not guaranteed as to its accuracy, and it is published solely for information purposes.