The Bank of England has taken a decisive step in its battle against stubborn inflation by raising its base interest rate from 5% to 5.25%. This marks the 14th consecutive rate hike as the central bank continues its efforts to control rising prices in the economy.

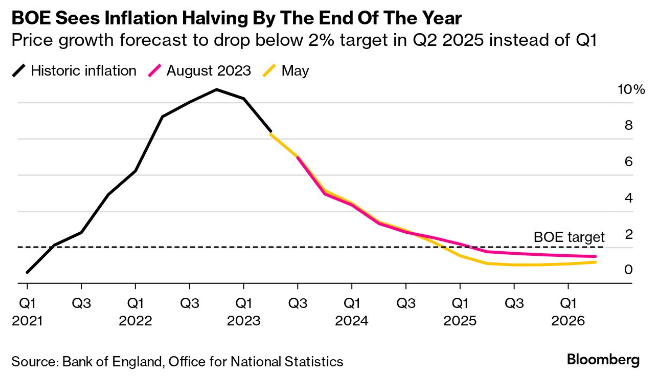

Economists had widely predicted this move, with most expecting a 0.25 percentage point increase to 5.25%. The decision comes after a significant jump in June when rates were raised from 4.5% to 5%. Despite inflation falling more than expected in June, the current rate of 7.9% remains nearly four times higher than the Bank of England’s 2% target.

The Monetary Policy Committee (MPC) voted with a majority of 6–3 in favor of the 0.25 percentage point hike. While two members preferred a larger 0.5 percentage point increase to 5.5%, one member voted to maintain the rate at 5%.

The MPC’s statement suggested that rates could remain above 5% throughout next year into 2025. However, it also implied that rates may now be close to their peak in this cycle of 14 rate rises.

The rate hike may bring further challenges for first-time buyers, homeowners on tracker mortgages, and those about to remortgage. Mortgage rates have been rising in recent months to reflect the increasing base rate and persistently high inflation. The average two-year residential mortgage rate currently stands at 6.85%, the highest level since August 2008.

Outlook for Interest Rates

Economists expect one or two more rate increases from the Bank of England. Some predict that interest rates will peak at 5.5%, while others believe they could reach 5.75%. Recent data, such as the drop in inflation from 8.7% to 7.9%, has caused economists to reassess their terminal rate expectations, now looking at around 5.75%.

The consensus is that rates are not likely to start falling until next year, probably in the second half of 2024. Some economists suggest that the Bank of England might cut rates faster and further than market expectations from the back end of 2024 and into 2025.

There are three more interest rate announcements scheduled this year: 21 September, 2 November, and 14 December.

Impact on Homeowners

For those with mortgages, another rate hike means higher borrowing costs. Customers with variable or tracker mortgages and those looking for new fixed-rate deals will find it more expensive to borrow money for their homes. The average tracker mortgage holder will pay around £24 more per month due to the 0.25 percentage point increase. Those on standard variable rate mortgages may face an average £15 increase.

While most mortgage holders on fixed-rate deals will not be immediately affected, millions of deals will end this year and next, leading to potentially higher payments when homeowners come to remortgage. However, experts suggest that the mortgage rate peak might be behind us or nearing its peak, particularly if inflation continues to drop.

Impact on Savers

An increase in the Bank rate is generally good news for savers. However, banks and building societies may not immediately raise savings rates in response. Customers will need to monitor their savings accounts actively and consider switching to get the best rates.

Despite recent rate hikes, savings rates could still be higher when compared to 15 years ago when the base rate was also 5.25%. The Bank of England and the Financial Conduct Authority have encouraged savings providers to offer better rates, especially on easy-access accounts. Currently, £250 billion sits in savings accounts earning zero interest.

In conclusion, while interest rates have risen, the outlook suggests further increases before rates eventually start to fall. Homeowners may face higher costs, while savers could still find better rates by seeking out competitive accounts. The Bank of England’s actions will continue to impact the overall economy, and consumers will need to remain vigilant about their financial decisions in this challenging economic environment.

FAQs

1. Why did the Bank of England raise interest rates to 5.25%?

The Bank of England raised interest rates to 5.25% in response to stubbornly high inflation. Despite inflation falling more than expected in June, it remains significantly above the Bank’s 2% target. The rate hike is part of the Bank’s efforts to control rising prices and stabilise the economy.

2. How many times has the Bank of England raised interest rates in this cycle?

This rate hike marks the 14th consecutive increase in the Bank of England’s base interest rate. The central bank has been gradually raising rates in response to inflationary pressures in the economy.

3. What are economists’ expectations for future interest rate changes?

Economists expect one or two more rate increases from the Bank of England. Some predict that interest rates will peak at 5.5%, while others believe they could reach 5.75%. The consensus is that rates are not likely to start falling until next year, probably in the second half of 2024.

4. How will the rate rise impact mortgage holders?

The rate rise will result in higher borrowing costs for mortgage holders on variable or tracker mortgages. Customers on a typical tracker mortgage may see their monthly payments increase by around £24 due to the 0.25 percentage point hike. Those on standard variable rate mortgages could face an average £15 increase.

5. What does the rate rise mean for savers?

An increase in the Bank rate is generally good news for savers, as it could lead to higher savings rates. However, banks and building societies may not immediately pass on the rate increase to all savings accounts. Savers are advised to actively monitor their accounts and consider switching to get the best rates.

6. Are mortgage rates expected to continue rising?

The outlook for mortgage rates remains uncertain. While some lenders have recently started to cut their rates, others have been slow to pass on the rate increases to savers. Experts suggest that average mortgage rates may drop from their current levels, but inflation and the central bank’s actions will continue to influence the market.

7. How will the rate hike impact the overall economy?

The rate hike could bring further challenges for first-time buyers, homeowners on tracker mortgages, and those about to remortgage. It may also impact consumer spending and business investment due to higher borrowing costs. The Bank of England’s actions will play a significant role in shaping the economic landscape, and consumers should remain vigilant about their financial decisions.

8. What should savers do to maximise their returns in this environment?

Savers should actively compare savings accounts and consider switching to those offering better rates. With inflation still high, it’s essential to ensure that savings are not eroded by inflationary pressures. Checking out competitive accounts, such as easy-access accounts, fixed-rate accounts and cash ISAs, can help savers make the most of their money.

9. How will the Bank of England’s future decisions impact borrowers and savers?

The Bank of England’s future rate decisions will have a direct impact on borrowers and savers. Any further rate increases will result in higher borrowing costs for mortgage holders and businesses. On the other hand, savers may benefit from higher savings rates as banks and building societies respond to the rate changes. It’s essential for individuals to stay informed about the central bank’s actions and consider their financial goals in light of the evolving economic environment.

Schedule Your Personalised Consultation Today!

Ready to take the next step towards achieving your financial goals? Schedule a call with one of our expert advisers today! Our team are here to provide guidance based on your unique financial situation and help you make the most of the insights gained from our resources. Don’t miss out on the opportunity to receive professional advice and tailored strategies. Take action now and let us guide you towards a brighter financial future.

Discover Market Insights!

Are you eager to make informed and strategic investment decisions? Look no further! Visit our Market Analysis page now to gain exclusive access to expert insights, trends, and data that can help shape your investment journey.

Access Our Financial Calculators!

Take control of your financial future with our comprehensive suite of Financial Calculators. Whether you’re planning for retirement, considering a mortgage, or exploring investment opportunities, our powerful tools can provide valuable insights to guide your decisions.

Disclaimer: The information provided on this website is for general informational purposes only and does not constitute financial or investment advice. The content on this website should not be considered as a recommendation or offer to buy or sell any securities or financial instruments. Investing in securities involves risks, and past performance is not indicative of future results. The value of an investment may fall as well as rise. You may get back less than the amount invested. Any reliance you place on such information is strictly at your own risk. The commentary provided should not be taken as financial advice as it does not take your financial circumstances into consideration and does not provide an objective view with your requirements in mind. The views are our opinions at the time of writing and may change based on incoming information. The data shared may be incorrect or out-dated at the time of reading. Our opinions are subject to change without notice and we are not under any obligation to update or keep this information current. The views expressed may no longer be current and may have already been acted upon. Tax treatment depends on individual circumstances and all tax rules may change in the future. The information contained on this page has been prepared using all reasonable care. However, it is not guaranteed as to its accuracy, and it is published solely for information purposes.