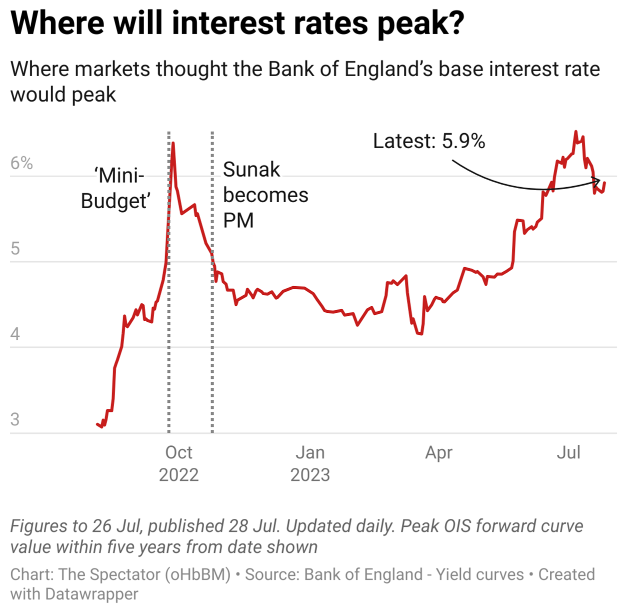

On Thursday, all eyes are on the Bank of England as they convene to decide on the next interest rate move. The crucial question is whether the rate hike will be a modest quarter percentage point increase or a more substantial half percentage point adjustment. The bank finds itself in a tight spot, grappling with inflation hovering at 7.9%, higher than in other developed nations, but showing signs of falling faster than anticipated.

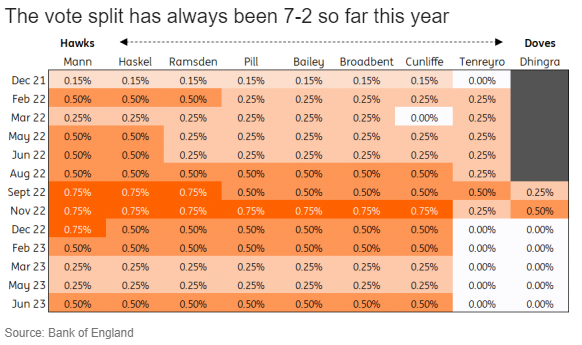

It is highly probable that another split vote will occur. However, it’s essential to take note that after Silvana Tenreyro’s second term expired, she was replaced by Megan Greene in early July. Tenreyro, known for her dovish stance and recent pattern of dissenting, will be succeeded by Greene, who previously served as the global chief economist at the Kroll Institute. It is expected that Greene will adopt a more hawkish approach compared to her predecessor and will likely align with the majority in her initial MPC meeting.

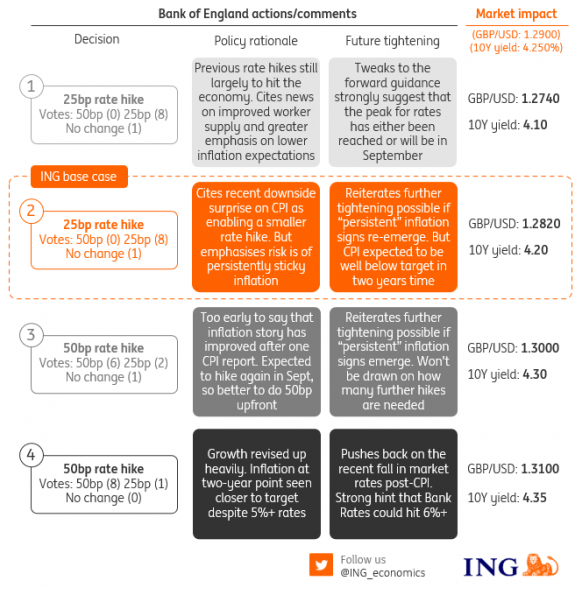

As the Monetary Policy Committee of the Bank of England gathers, the consensus points towards a 25 basis point rise, but there are staunch advocates for a larger 50 basis point increase, while others advocate for a pause in further rate hikes. This decision will have significant implications for the British pound and UK interest rates, making it a defining moment for the country’s economic trajectory.

The dynamics of central bank rate adjustments and their impact on the real economy play a crucial role in shaping market expectations. The central bank can either make money more expensive or cheaper. When rates rise, borrowing costs increase and savings rates improve. This leads to reduced demand in the economy as money flows into longer-term deposits, discouraging excessive borrowing and spending by consumers and businesses.

However, the challenge lies in the transmission of these adjustments to the real economy. The recent Financial Conduct Authority (FCA) report indicated that only 28% of the central bank’s rate increases were passed on to savers through interest rate increments in deposits. Many banks have until the end of August to justify why they have not passed on the central bank’s savings to consumers. This disconnect between central bank actions and the actual rates experienced by consumers may complicate the Bank of England’s rate hike cycle, potentially causing a more turbulent and extended path.

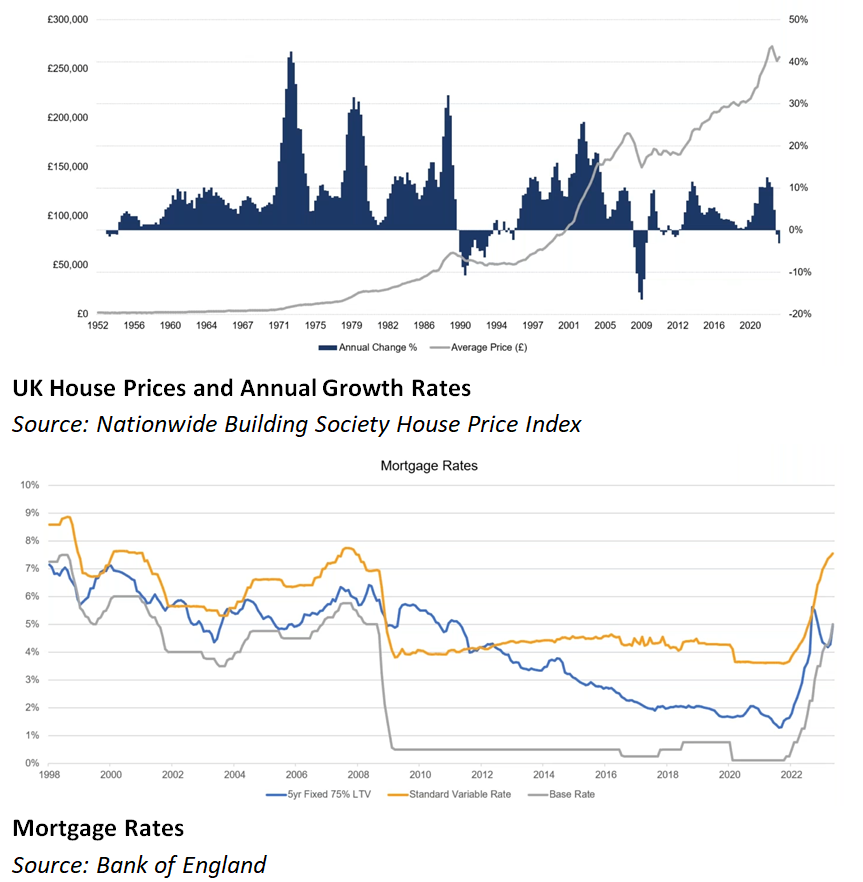

The housing market is also set to be affected by the rate decision. Following a gradual 0.25 percentage point Bank Rate rise, mortgage rates could potentially see reductions, benefiting homebuyers. If the Bank of England avoids surprising markets with a larger-than-expected rate hike, lenders may regain confidence and start competing for a limited pool of borrowers. However, strong economic headwinds and affordability challenges remain significant factors for prospective and existing borrowers.

Concerning UK house prices, the 3.8% fall in the year to July has caught attention. Some observers are surprised that the decline hasn’t been more substantial, while others anticipate further drops as interest rate increases take their toll on the economy. However, a lack of housing supply due to planning restrictions and a shortage of new homes has kept prices relatively stable for buyers and renters.

Amidst a cost-of-living crisis, a glimmer of positive news emerges as UK store prices have seen their first drop in two years. The British Retail Consortium reported a 0.1% decrease in shop prices in July compared to June. Annual inflation has also eased from 8.4% in June to 7.6% in July. Reduced prices in cooking oils, fats, fish, and breakfast cereals, along with discounts offered by clothing and footwear retailers due to adverse weather conditions, offer some relief for consumers.

The Bank of England’s decision on interest rates will be closely watched as the country navigates its economic course amid various challenges. Market participants, borrowers, and savers alike are eagerly anticipating the outcome, which will have far-reaching implications for the British economy and beyond.

FAQs

1. What is the Bank of England’s role in setting interest rates?

The Bank of England is the central bank of the United Kingdom and is responsible for setting the country’s monetary policy, including interest rates. The Monetary Policy Committee (MPC) of the Bank of England meets regularly to decide on changes to the Bank Rate, which influences borrowing and lending rates throughout the economy.

2. Why is the Bank of England considering raising interest rates?

The Bank of England is closely monitoring inflation levels in the UK. With inflation currently at 7.9%, higher than other developed nations, the bank is exploring options to control rising prices and stabilise the economy. Raising interest rates can help curb inflation by reducing spending and borrowing, making saving more attractive.

3. What are the possible outcomes of the Bank of England’s rate decision?

The upcoming rate decision may result in a 25 basis point increase, commonly referred to as a quarter percentage point hike. However, there are differing views within the MPC, with some advocating for a larger 50 basis point rise. Additionally, others believe that a pause in further rate increases might be necessary to assess the full impact of previous hikes on the UK economy.

4. How might interest rate changes affect mortgage rates for homebuyers?

Following the Bank of England’s rate decision, mortgage rates could see potential reductions, benefitting homebuyers. However, this is contingent on the central bank’s chosen course of action and how lenders respond to the rate change.

5. What is the impact of inflation on the UK housing market?

The UK housing market has seen a decline of 3.8% in house prices over the year to July. While some expected deeper price falls, factors like restricted housing supply and a shortage of new homes have contributed to the market’s relative stability for both buyers and renters.

6. How does the Bank of England’s monetary policy affect consumers’ financial products?

The Bank of England’s decisions on interest rates can have implications for consumers’ financial products such as savings accounts and mortgages. When the central bank raises rates, savers might see higher interest rates on deposits, while borrowers may experience increased borrowing costs.

7. Will the Bank of England’s rate hike address the cost-of-living crisis in the UK?

The cost-of-living crisis in the UK remains a significant concern for many households. While the Bank of England’s rate decisions can influence certain aspects of the economy, it may not single-handedly resolve all the underlying factors contributing to the cost-of-living challenges.

8. How is the Bank of England’s ability to influence the economy limited by financial infrastructure?

The transmission of central bank rate adjustments to the real economy can be influenced by the financial infrastructure and practices of retail banks. If banks do not pass on central bank savings to consumers promptly, it could potentially hinder the desired impact on the broader economy.

9. What should consumers consider before taking advantage of mortgage deals?

Before opting for mortgage deals following a rate hike, consumers are advised to conduct stress testing to evaluate their affordability and assess the potential impact of future rate changes on their mortgage payments.

10. How might the UK economy’s performance differ from the US Federal Reserve’s decisions?

While both the Bank of England and the US Federal Reserve are central banks that influence their respective economies, their policy decisions and economic environments may differ, leading to variations in interest rate changes and economic outcomes.

Schedule Your Personalised Consultation Today!

Ready to take the next step towards achieving your financial goals? Schedule a call with one of our expert advisers today! Our team are here to provide guidance based on your unique financial situation and help you make the most of the insights gained from our resources. Don’t miss out on the opportunity to receive professional advice and tailored strategies. Take action now and let us guide you towards a brighter financial future.

Discover Market Insights!

Are you eager to make informed and strategic investment decisions? Look no further! Visit our Market Analysis page now to gain exclusive access to expert insights, trends, and data that can help shape your investment journey.

Access Our Financial Calculators!

Take control of your financial future with our comprehensive suite of Financial Calculators. Whether you’re planning for retirement, considering a mortgage, or exploring investment opportunities, our powerful tools can provide valuable insights to guide your decisions.

Disclaimer: The information provided on this website is for general informational purposes only and does not constitute financial or investment advice. The content on this website should not be considered as a recommendation or offer to buy or sell any securities or financial instruments. Investing in securities involves risks, and past performance is not indicative of future results. The value of an investment may fall as well as rise. You may get back less than the amount invested. Any reliance you place on such information is strictly at your own risk. The commentary provided should not be taken as financial advice as it does not take your financial circumstances into consideration and does not provide an objective view with your requirements in mind. The views are our opinions at the time of writing and may change based on incoming information. The data shared may be incorrect or out-dated at the time of reading. Our opinions are subject to change without notice and we are not under any obligation to update or keep this information current. The views expressed may no longer be current and may have already been acted upon. Tax treatment depends on individual circumstances and all tax rules may change in the future. The information contained on this page has been prepared using all reasonable care. However, it is not guaranteed as to its accuracy, and it is published solely for information purposes.