Navigating the UK’s tax system can feel like a maze, especially with its complexity and the ever-changing financial landscape. But fear not, let’s break down some the key points to help you make sense of it all.

UK Income Tax Bands and Graduated Taxation

The UK income tax system operates through a series of graduated tax bands, where tax rates increase with income. Contrary to a common misconception, entering a higher tax band doesn’t mean paying the higher rate on all income. Instead, each portion of income is taxed at its respective band rate. Understanding this progressive taxation system is essential for optimising tax strategies and financial planning.

Progressive Taxation and Income Distribution

Progressive taxation imposes heavier tax burdens on higher earners, while simultaneously reducing or eliminating personal allowances for those earning over certain tax bands. Conversely, lower earners benefit from reduced tax liabilities and access to various government benefits like Universal Credit, Job Seekers Allowance and Housing Benefit. This dynamic taxation structure aims to ensure basic needs are met for all citizens but can also contribute to a redistribution of income, pulling high earners back into the middle income bracket of the income distribution. While lower earners pay less tax and receive additional benefits are being pushed up into the middle income bracket of the income distribution curve. Therefore we have a large group of people in a forced ‘normal’ distribution who are neither extremely wealthy or extremely poor. Therefore, taxes are setup to ensure most people end up falling into the normal distribution and can never become wealthy on earned income alone.

Utilising Capitals Gains and Dividends to Optimise Tax Efficiency

The two most effective ways to pay less tax and keep more of your money are through realised capital gains and dividends as they offer more favourable tax treatment compared to earned income. Both represent individuals with significant opportunities to reduce tax liabilities and retain more of their earnings. Capital gains arise when selling investments for a higher price than you paid for it also know as a profit, you will pay capital gains on only the gain made. A dividend is a distribution of earnings (income) by a company to its shareholders which are also subject to lower tax rates. Both of these options provide an avenue for tax-efficient wealth accumulation beyond traditional earned income. Therefore the more investments you have, the less taxes you will pay when you take profit where CGT applies or take an income where dividend applies. Each person needs to consider the right amount of funds from their income to be diverted from savings into investments such as equities and properties to optimise tax efficiency, in the future, replacing earned income with realised capital gains and dividend income should be the goal. Do you have the right tax strategy that can help you save your earned income?

Benefits of owning a company

Another effective way to retain more of your earnings is to become a company owner. Unlike employees who face substantial tax burdens, owning a company offers numerous tax advantages. By operating as a limited company, even for small businesses or side hustles, individuals can significantly reduce their tax liabilities. For instance, an employee earnings would result in taxes on the total amount earned. However, the same earnings through a limited company would allow individuals to deduct business expenditures, resulting in substantially higher take-home pay. Additionally, corporate tax rates are generally lower than income tax rates. Moreover, individuals can choose to withdraw earnings as dividends, which are taxed at much lower rates compared to income tax. This favourable tax treatment of corporate structures explains why many of the wealthiest individuals are corporate shareholders.

Building Wealth and Reducing Reliance on Traditional Employment

To maximise wealth accumulation and retention, individuals should consider reducing their reliance on traditional employment income alone. You can see this across top executive salaries which only form a fraction of earnings, dividends and share value appreciation constitute the majority. By understanding the limitations of income and embracing opportunities like equities and properties, individuals can potentially increase their earnings and retain more of the income produced. While this approach may not suit everyone due to varying risk appetites and career preferences, it offers a path to higher rewards and greater control over financial outcomes.

By strategically managing one’s income and investments, individuals can potentially optimise their tax liabilities and maximise their after-tax returns. For instance, investors may consider utilizing tax-efficient investment vehicles or timing the realisation of capital gains to minimise tax exposure. Such proactive tax planning can lead to significant savings and financial benefits.

Marriages and Civil Partnerships have favourable tax legislation

This means that married couples and civil partners often enjoy certain tax advantages and incentives compared to unmarried individuals or couples in cohabitation. The UK tax system offers various allowances, reliefs, or exemptions specifically designed to benefit married couples and civil partners. These tax benefits can include the ability to transfer assets between spouses or partners without incurring tax liabilities, favourable inheritance tax treatment, or eligibility for certain tax credits and deductions. By acknowledging and prioritizing marriage and civil partnerships within tax laws, the UK government aims to promote stability within families and provide financial support to couples committed to long-term relationships.

Learn what Tax Evasion and Avoidance Means

Within tax matters, there are always concerns regarding both evasion and avoidance. It’s crucial to distinguish between the two, as evasion involves illegal activities aimed at deliberately evading taxes owed to the government, whereas avoidance refers to the lawful act of minimising tax liabilities through legitimate means. An Individual Savings Account (ISA), for instance, exemplifies a sanctioned method of tax avoidance endorsed by the government. By investing in an ISA, individuals can shelter their savings and investments from certain taxes within the bounds of the law, thereby reducing their overall tax burden.

Understanding tax rules, using smart planning, and taking of advantage of tax allowances and vehicles are key to saving money on taxes. By staying updated on tax laws, we follow the rules and find ways to pay less tax legally. Planning ahead with proven strategies helps organise finances to pay the least amount of tax possible. Additionally, using tax allowances and vehicles provided by the government helps individuals make the most of their money.

Allowances and Exemptions

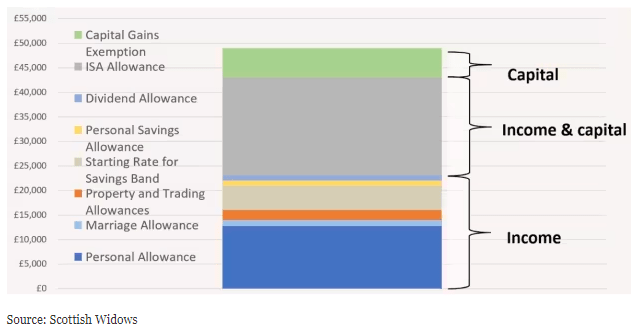

Allowances are available on income, capital or both. If added together the current allowances, and one exemption, total £49,010 this tax year. In the 2020-21 tax year the total figure was £55,570. There is a 13% reduction. The reason behind this is due to the freezing of tax bands and the reduction of the capital gains tax allowance and dividend allowance.

Ready to take control of your financial and keep what you earn? Contact us today to schedule a consultation and discover how our personalised strategies can help you achieve your long-term goals. Don’t wait – let’s embark on this journey together.

The personal allowance determines the amount of income one can earn before paying taxes, set at £12,570 for 2024-25. This allowance is frozen until 2027-28, effectively decreasing its real value. Marriage allowance allows transferring £1,260 of personal allowance to a basic rate-paying partner, saving £252 in tax, and can be backdated up to four years. Trading and property allowances offer up to £1,000 each tax year for respective incomes, beneficial for casual traders and those in the sharing economy. The personal savings allowance permits tax-free savings of up to £1,000 annually for basic rate payers, £500 for higher rate payers and additional rate taxpayers do not benefit. This can be combined with the starting rate for savings, allowing up to £5,000 in tax-free savings interest. For every £1 of other income earned above the personal allowance of £12,570, it reduces the starting rate for savings by £1. It’s recommended to maximise ISAs as interest earned doesn’t affect the personal savings allowance. Are you maximising your ISA allowances?

Looking at just the reduction in capital gains allowance and dividend allowance from 2022-23 with the most recent 2024-25, there is a 75% reduction. Even still, capital gains tax rate is still lower than income tax rates, especially for additional rate taxpayers. To counter the impact of the lower capital gains tax (CGT) allowance, several actions can be taken:

- Use losses from previous years to offset against the reduced allowances.

- Maximise contributions to Individual Savings Accounts (ISAs) and pensions.

- Utilise spouse or civil partner allowances by transferring assets.

- Employ strategies like “Bed & ISA” or “Bed & Pension,” involving selling assets and repurchasing them within a tax-advantaged account.

- Consider “Bed & spouse/civil partner” strategies, transferring assets to utilise their allowances.

- Utilise trusts to pass capital gains through gifts, potentially benefiting from holdover relief, although trustees’ CGT rates are higher.

- Defer CGT by reinvesting gains in Enterprise Investment Schemes (EIS).

The dividend allowance can receive up to £1,000 of dividend income tax-free, with a further reduction planned for the 2024-25 tax year to £500. Despite these reductions, dividend tax rates remain lower than income tax rates.

Tax Traps to Avoid:

- Loss of allowances as income increases, leading to higher effective tax rates.

- Marriage Allowance is lost if one partner becomes a higher rate taxpayer.

- High income can lead to loss of benefits like Child Benefit.

Tax trap planning considerations

Maximise use of allowances and exemptions between spouse/civil partner to remain within tax thresholds and limits. Also transfer savings and investment income for tax efficiency. Make increased pension contributions to extend basic rate tax band and potentially gain higher rates of pension relief at source.

Taking advantage of all available reliefs, exemptions, and allowances can significantly alleviate the overall tax burden. It’s crucial to remember that if you’re married or in a civil partnership, leveraging both partners’ allowances and exemptions is an excellent initial strategy. Additionally, safeguarding investments within appropriate tax wrappers to optimise tax efficiency and increasing contributions to pensions can help navigate potential tax traps effectively. By implementing these measures, individuals can proactively manage their tax liabilities and potentially enhance their financial well-being.

As the new tax year begins, maximise your tax strategy today with our experts and build your financial plan. Schedule a personalised tax strategy call today.

Frequently Asked Questions

1. What are the UK income tax bands, and how does graduated taxation work?

The UK income tax system operates through graduated tax bands, where tax rates increase with income. Contrary to a common misconception, entering a higher tax band doesn’t mean paying the higher rate on all income. Instead, each portion of income is taxed at its respective band rate. Understanding this progressive taxation system is essential for optimising tax strategies and financial planning.

2. How does progressive taxation affect income distribution?

Progressive taxation imposes heavier tax burdens on higher earners, while reducing or eliminating personal allowances for those earning over certain tax bands. Lower earners benefit from reduced tax liabilities and access to government benefits. This dynamic structure aims to ensure basic needs are met for all citizens and contributes to income redistribution.

3. How can capital gains and dividends be utilised to optimise tax efficiency?

Realised capital gains and dividends offer more favourable tax treatment compared to earned income. By strategically managing investments, individuals can reduce tax liabilities and retain more earnings. Maximising these avenues is crucial for long-term wealth accumulation and tax efficiency.

4. What are the benefits of owning a company in terms of tax advantages?

Owning a company offers numerous tax advantages, including deductions for business expenditures and lower corporate tax rates. Dividends can be withdrawn at lower tax rates compared to income tax. Operating as a limited company can significantly reduce tax liabilities for individuals.

5. How can individuals reduce reliance on traditional employment income for wealth accumulation?

By diversifying income sources through investments like equities and properties, individuals can potentially increase earnings and retain more income. Understanding the limitations of earned income and embracing investment opportunities is key to building wealth and financial independence.

6. What are the tax advantages for married couples and civil partners?

Married couples and civil partners often enjoy tax advantages and incentives, including allowances, reliefs, and exemptions designed to benefit them. These can include asset transfers without tax liabilities, favourable inheritance tax treatment, and eligibility for tax credits and deductions.

7. What is the difference between tax evasion and tax avoidance?

Tax evasion involves illegal activities aimed at deliberately evading taxes owed to the government, while tax avoidance refers to minimising tax liabilities through legitimate means. Understanding this distinction is crucial for compliance with tax laws and ethical financial practices.

8. What are some allowances and exemptions available for taxpayers?

Taxpayers can benefit from various allowances and exemptions, such as the personal allowance, marriage allowance, trading and property allowances, and personal savings allowance. Maximising these allowances can significantly reduce overall tax burdens.

9. How can individuals counter the impact of reduced capital gains and dividend allowances?

Strategies include utilising losses from previous years, maximising contributions to ISAs and pensions, employing spouse or civil partner allowances, and considering investment in tax-advantaged schemes like Enterprise Investment Schemes (EIS).

10. What are some tax traps to avoid?

Loss of allowances with increasing income, loss of benefits like Child Benefit with high income, and the impact of becoming a higher rate taxpayer on marriage allowance are key traps to avoid. Planning considerations include maximising use of allowances and exemptions and transferring income for tax efficiency.

11. How can individuals proactively manage their tax liabilities?

Leveraging allowances and exemptions, safeguarding investments within tax wrappers, increasing pension contributions, and seeking professional advice can help individuals navigate tax complexities effectively and enhance their financial well-being.

Schedule Your Personalised Consultation!

Ready to take the next step towards achieving your financial goals?

Discover Market Insights!

Access Our Financial Calculators!

Disclaimer: The information provided on this website is for general informational purposes only and does not constitute financial or investment advice. The content on this website should not be considered as a recommendation or offer to buy or sell any securities or financial instruments. Investing in securities involves risks, and past performance is not indicative of future results. The value of an investment may fall as well as rise. You may get back less than the amount invested. Any reliance you place on such information is strictly at your own risk. The commentary provided should not be taken as financial advice as it does not take your financial circumstances into consideration and does not provide an objective view with your requirements in mind. The views are our opinions at the time of writing and may change based on incoming information. The data shared may be incorrect or out-dated at the time of reading. Our opinions are subject to change without notice and we are not under any obligation to update or keep this information current. The views expressed may no longer be current and may have already been acted upon. Tax treatment depends on individual circumstances and all tax rules may change in the future. The information contained on this page has been prepared using all reasonable care. However, it is not guaranteed as to its accuracy, and it is published solely for information purposes.