In an ever-evolving financial landscape, mastering the art of navigating market volatility is essential for investors seeking to safeguard their portfolios and seize opportunities amidst uncertainty. Join us as we delve into recent market movements and unveil strategies to thrive in turbulent times.

As we begin a new trading week after a long Bank Holiday weekend, let us catch up on the key events from last week and what to expect for the week ahead. Investors find themselves at the epicentre of market volatility, grappling with shifting economic indicators and geopolitical tensions. Against this backdrop, understanding the intricacies of market dynamics is paramount to achieving financial success.

Last week’s market dynamics were characterised by a delicate balancing act between economic data, central bank policies and geopolitical tensions. Investors navigated through a maze of uncertainty, reacting to each development with a keen eye on preserving capital and maximising returns.

The US Dollar faced selling pressure as disappointing economic data dampened expectations of a robust recovery. Despite solid corporate earnings and positive sentiment surrounding the reopening of the economy, concerns lingered about the pace of economic growth and the potential for inflationary pressures and delayed cuts in the interest rate.

Federal Reserve Chairman Jay Powell’s dovish remarks further weighed on the US Dollar, as he reiterated the central bank’s commitment to maintaining accommodative monetary policy. While the Fed kept interest rates unchanged, investors interpreted Powell’s commentary as a signal that the pace of quantitative tightening (QT) could be slower than anticipated.

Commodity currencies, including the Australian Dollar (AUD), New Zealand Dollar (NZD), and Norwegian Krone (NOK), capitalised on USD weakness, rallying against the greenback. The Canadian Dollar (CAD), however, underperformed amid volatile oil prices, which experienced a notable downturn during the week.

Precious metals, often viewed as safe-haven assets during times of uncertainty, faced downward pressure amidst easing yields and Dollar strength. Gold and Silver experienced a technical correction within their broader uptrend, offering investors an opportunity to reassess their positions and potentially accumulate these assets at more favourable levels.

Equities, on the other hand, displayed resilience in the face of market volatility, with the S&P500 index posting modest gains. Positive sentiment surrounding corporate earnings, particularly from tech giants like Apple, buoyed investor confidence and provided support to risk assets.

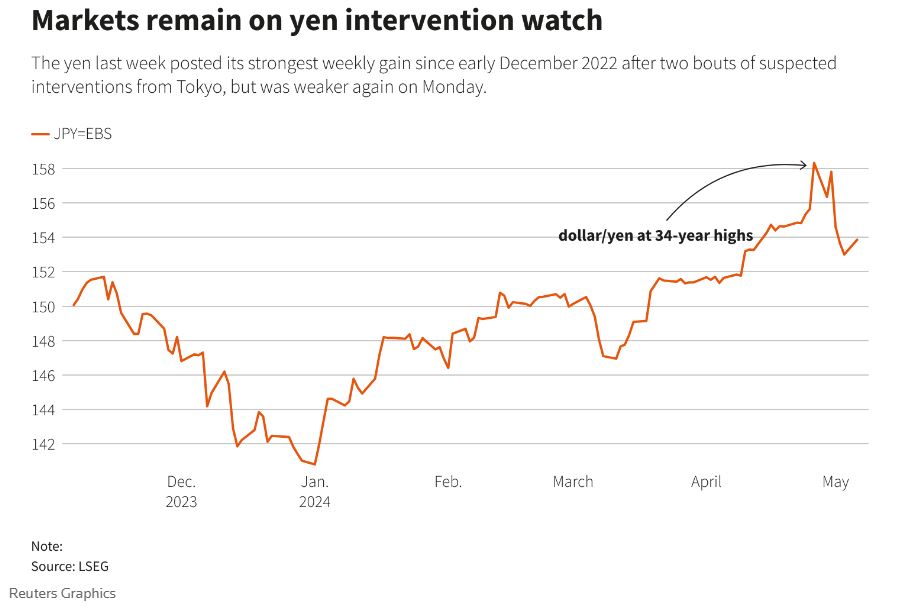

Japanese stocks generated positive returns amidst speculation of intervention in foreign exchange markets by Japanese authorities to prop up the yen. The TOPIX Index rose, reflecting market optimism amid ongoing efforts to stabilise currency markets.

Insights and Strategies

Against the backdrop of market volatility, investors must remain vigilant and adaptable. Diversification across asset classes, including equities, bonds, commodities and precious metals, can help mitigate risks and capitalise on opportunities arising from market fluctuations.

Strategic allocation to precious metals, such as Gold and Silver, serves as a hedge against inflationary pressures and currency devaluation. These assets offer protection to investors’ portfolios during times of economic uncertainty and geopolitical tensions.

Monitoring central bank policies, economic indicators, and geopolitical developments is essential for making informed investment decisions. By staying informed and responsive to evolving market dynamics, investors can position themselves to navigate through volatile periods with confidence.

Looking Ahead

As the markets digest the events of the past week, continued volatility is anticipated. Investors should closely monitor upcoming economic data releases, central bank announcements, and geopolitical developments to gauge market sentiment and identify potential opportunities. Data-wise we have more PMIs and interest rate decisions from the RBA and BoE.

With the Federal Reserve maintaining its dovish stance and economic data continuing to influence market sentiment, investors must remain agile and adaptable in their investment approach. By staying disciplined and focused on their long-term investment objectives, investors can navigate through market volatility with confidence and resilience.

Note: Market conditions are subject to change, and this overview is based on information available at the time of writing. The information provided in this article is for educational purposes only and does not constitute investment advice. Past performance is not indicative of future results.

Sources: Reuters, Bloomberg, CNBC and Financial Times

FAQs

1. What impact does inflation have on the financial markets?

Inflation can affect various asset classes differently. Generally, rising inflation can lead to higher interest rates, which may negatively impact bond prices but benefit sectors like commodities and real estate.

2. How does foreign exchange (FX) intervention influence currency markets?

FX intervention by central banks can affect exchange rates by increasing or decreasing demand for a particular currency. For example, when a central bank intervenes to weaken its currency, it may sell its own currency, leading to a depreciation.

3. What role does the Federal Reserve play in shaping market sentiment?

The Federal Reserve, as the central bank of the United States, has a significant influence on market sentiment through its monetary policy decisions. Interest rate changes, quantitative easing measures, and forward guidance provided by the Fed can impact investor confidence and asset prices.

4. How do corporate earnings reports impact stock markets?

Corporate earnings reports provide insights into the financial health and performance of companies. Positive earnings surprises or strong guidance can lead to stock price increases, while disappointments may result in declines. Earnings announcements often contribute to short-term volatility in the stock market.

5. What factors contribute to the volatility of oil prices?

Oil prices are influenced by various factors, including geopolitical tensions, supply and demand dynamics, global economic conditions, and production decisions by oil-producing countries such as OPEC and Russia. Unexpected events such as conflicts or natural disasters can also lead to short-term price fluctuations.

6. How do investors navigate market uncertainty and manage risk?

Investors can manage risk by diversifying their portfolios across different asset classes, regions, and sectors. Additionally, staying informed about market developments, maintaining a long-term perspective, and adhering to a disciplined investment strategy can help investors navigate market volatility and uncertainty.

7. What are the potential implications of central bank interest rate decisions on the economy?

Central bank interest rate decisions can influence borrowing costs, consumer spending, business investment, and overall economic activity. Lower interest rates can stimulate borrowing and investment, potentially boosting economic growth, while higher rates may cool down inflationary pressures but could also slow down economic expansion.

If you have specific questions or concerns about your investments, don’t hesitate to reach out to our financial advisers for personalised guidance and recommendations.

Schedule Your Personalised Consultation Today!

Ready to take the next step towards achieving your financial goals? Schedule a call with one of our expert advisers today! Our team are here to provide guidance based on your unique financial situation and help you make the most of the insights gained from our resources. Don’t miss out on the opportunity to receive professional advice and tailored strategies. Take action now and let us guide you towards a brighter financial future.

Discover Market Insights!

Are you eager to make informed and strategic investment decisions? Look no further! Visit our Market Analysis page now to gain exclusive access to expert insights, trends, and data that can help shape your investment journey.

Access Our Financial Calculators!

Take control of your financial future with our comprehensive suite of Financial Calculators. Whether you’re planning for retirement, considering a mortgage, or exploring investment opportunities, our powerful tools can provide valuable insights to guide your decisions.

Disclaimer: The information provided on this website is for general informational purposes only and does not constitute financial or investment advice. The content on this website should not be considered as a recommendation or offer to buy or sell any securities or financial instruments. Investing in securities involves risks, and past performance is not indicative of future results. The value of an investment may fall as well as rise. You may get back less than the amount invested. Any reliance you place on such information is strictly at your own risk. The commentary provided should not be taken as financial advice as it does not take your financial circumstances into consideration and does not provide an objective view with your requirements in mind. The views are our opinions at the time of writing and may change based on incoming information. The data shared may be incorrect or out-dated at the time of reading. Our opinions are subject to change without notice and we are not under any obligation to update or keep this information current. The views expressed may no longer be current and may have already been acted upon. Tax treatment depends on individual circumstances and all tax rules may change in the future. The information contained on this page has been prepared using all reasonable care. However, it is not guaranteed as to its accuracy, and it is published solely for information purposes.