In the current economic climate, speculation is rife about the Bank of England’s next move concerning interest rates. On Thursday, analysts widely anticipate a rate cut, a decision driven by a combination of economic indicators and global market dynamics. Understanding the rationale behind this expected policy shift provides insight into the broader economic landscape and helps investors make informed decisions.

Economic Indicators Signalling a Rate Cut

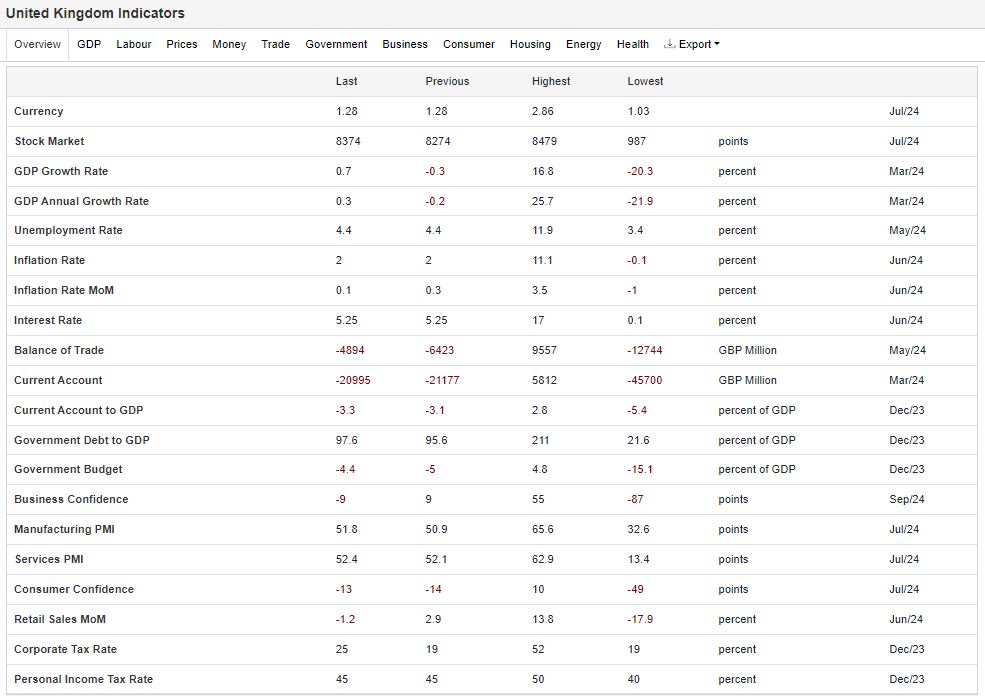

Inflation and Economic Growth

The primary driver behind the anticipated rate cut is the recent fall in inflation coupled with stagnant economic growth. Despite previous interest rate hikes aimed at curbing inflation, consumer prices have remained stubbornly high, affecting purchasing power and overall economic confidence. The Bank of England has been closely monitoring these trends, and a rate cut is seen as a necessary measure to stimulate economic activity by reducing borrowing costs and encouraging spending.

Consumer Confidence and Spending

Consumer confidence is a crucial component of economic health, and recent data indicates a significant decline. Higher interest rates have led to increased borrowing costs, dampening consumer spending and, by extension, economic growth. A rate cut would lower the cost of borrowing for consumers, potentially revitalising spending and driving economic activity. This move is also expected to alleviate some of the financial pressures on households, especially those with variable-rate mortgages.

Global Economic Conditions

The global economic environment also plays a significant role in the Bank of England’s decision-making process. International trade tensions and economic slowdowns in major economies like the US and China have had ripple effects on the UK economy. Lowering interest rates could help mitigate some of these external pressures by making UK exports more competitive and attracting foreign investment.

Potential Impacts of a Rate Cut

Housing Market

A reduction in interest rates is likely to have a positive impact on the housing market. Lower mortgage rates could make homeownership more affordable, stimulating demand in the housing sector. This could be particularly beneficial for first-time buyers and those looking to re-mortgage at more favourable rates.

Investment and Business Growth

For businesses, a rate cut can reduce the cost of financing, encouraging investment in growth and expansion. This is particularly important for small and medium-sized enterprises (SMEs) that are sensitive to changes in borrowing costs. Increased business investment can lead to job creation and higher economic output, further supporting the overall economy.

Financial Markets

Financial markets are likely to react positively to a rate cut, with potential gains in equity markets as lower interest rates improve corporate profit margins and investor sentiment. However, it is also important to monitor the impact on the pound sterling, as a rate cut could lead to a depreciation, affecting import prices and trade balances.

Investor Insights:

- Stock Market: Investors should look for potential gains in sectors that benefit from lower borrowing costs, such as real estate and consumer goods. Companies with high debt levels might see improved margins, making them attractive.

- Bond Market: Falling interest rates usually lead to higher bond prices. Consider increasing exposure to long-term bonds which may benefit more significantly from rate cuts.

- Currency Impact: The expected rate cut could weaken the pound, making UK exports cheaper and potentially boosting revenue for UK companies with significant overseas sales.

- Real Estate: Lower mortgage rates might drive demand in the property market. Investors could consider real estate investment trusts (REITs) to capitalise on potential growth in this sector.

- Diversification: Ensure your portfolio is well-diversified to mitigate risks. Include a mix of equities, bonds and alternative investments.

- Monitor Commodities: Keep an eye on commodities like gold, which often perform well during periods of low interest rates and economic uncertainty.

- Review Emerging Markets: With lower interest rates in developed markets, there might be increased capital flows into emerging markets, providing potential growth opportunities.

Conclusion

The Bank of England’s potential rate cut is a strategic response to a complex array of economic challenges. By lowering interest rates, the Bank aims to stimulate economic growth, support consumer spending, and enhance business investment.

Note: Market conditions are subject to change, and this overview is based on information available at the time of writing. The information provided in this article is for educational purposes only and does not constitute investment advice. Past performance is not indicative of future results.

Sources: Reuters, Bloomberg, CNBC and Financial Times

FAQs

1. Why might the Bank of England cut interest rates?

The Bank of England may cut interest rates to stimulate economic growth, reduce borrowing costs, increase consumer spending, and support businesses. This move is often considered when inflation is high, consumer confidence is low, and economic growth is stagnant.

2. How does a rate cut affect mortgage rates?

A rate cut typically leads to lower mortgage rates, making borrowing cheaper for homebuyers and homeowners looking to remortgage. This can make homeownership more affordable and stimulate the housing market.

3. What impact does a rate cut have on savings?

Lower interest rates usually result in lower returns on savings accounts. Savers may earn less interest on their deposits, savers should consider investment opportunities to capture higher returns.

4. How does a rate cut influence the stock market?

Lower interest rates can boost the stock market as borrowing costs decrease, improving corporate profit margins. Investors might move their funds from low-yield savings to stocks, driving up stock prices.

5. What is the impact on the currency exchange rate?

A rate cut often weakens the national currency, making exports cheaper and more competitive internationally. However, it can also increase the cost of imports and contribute to higher inflation.

6. How does a rate cut affect inflation?

By lowering borrowing costs and encouraging spending, a rate cut can help increase demand, which may eventually lead to higher inflation. However, it aims to balance this by stimulating economic growth.

7. What are the risks of cutting interest rates?

Potential risks include inflation rising too quickly, reduced returns for savers, and the potential for creating asset bubbles due to increased borrowing and spending.

8. How frequently does the Bank of England review interest rates?

The Bank of England’s Monetary Policy Committee (MPC) reviews interest rates every six weeks, at which point they decide whether to adjust rates based on economic conditions.

9. What should investors do in anticipation of a rate cut?

Investors might consider diversifying their portfolios, focusing on sectors that benefit from lower borrowing costs. Monitoring bond markets and considering long-term bonds may also be prudent.

10. How can businesses benefit from a rate cut?

Businesses can benefit from lower borrowing costs, making it cheaper to finance expansion and investment. This can lead to increased business growth, job creation, and higher economic output.

If you have specific questions or concerns about your investments, don’t hesitate to reach out to our financial advisers for personalised guidance and recommendations.

Schedule Your Personalised Consultation Today!

Ready to take the next step towards achieving your financial goals? Schedule a call with one of our expert advisers today! Our team are here to provide guidance based on your unique financial situation and help you make the most of the insights gained from our resources. Don’t miss out on the opportunity to receive professional advice and tailored strategies. Take action now and let us guide you towards a brighter financial future.

Discover Market Insights!

Are you eager to make informed and strategic investment decisions? Look no further! Visit our Market Analysis page now to gain exclusive access to expert insights, trends, and data that can help shape your investment journey.

Access Our Financial Calculators!

Take control of your financial future with our comprehensive suite of Financial Calculators. Whether you’re planning for retirement, considering a mortgage, or exploring investment opportunities, our powerful tools can provide valuable insights to guide your decisions.

Disclaimer: The information provided on this website is for general informational purposes only and does not constitute financial or investment advice. The content on this website should not be considered as a recommendation or offer to buy or sell any securities or financial instruments. Investing in securities involves risks, and past performance is not indicative of future results. The value of an investment may fall as well as rise. You may get back less than the amount invested. Any reliance you place on such information is strictly at your own risk. The commentary provided should not be taken as financial advice as it does not take your financial circumstances into consideration and does not provide an objective view with your requirements in mind. The views are our opinions at the time of writing and may change based on incoming information. The data shared may be incorrect or out-dated at the time of reading. Our opinions are subject to change without notice and we are not under any obligation to update or keep this information current. The views expressed may no longer be current and may have already been acted upon. Tax treatment depends on individual circumstances and all tax rules may change in the future. The information contained on this page has been prepared using all reasonable care. However, it is not guaranteed as to its accuracy, and it is published solely for information purposes.